Tips and Tricks for a 1 Minute Scalping Strategy in Forex

Have you ever witnessed a trader who opens dozens of trades during a day only to close them a few seconds or minutes later?

That trader follows a scalping trading style. Learn

They try to make a profit on very small price movements.

Since the profits are low, a scalper needs to open a large number of trades during a day in order to make a respectable amount of profit.

But beware: Scalping can be difficult, especially to inexperienced traders.

If you want to master the art of scalping, start first with some longer-term trading styles and try to become consistently profitable with them. Since scalping requires lightning-fast reflexes, fast decision making and nerves of steel, there’s no reason to believe that you would be a successful scalper if you can’t make a profit with day trading and swing trading.

- Learn more, take our premium course: Trading for Beginners

1-Minute Forex Scalping Strategy

In the following lines, we’ll cover a simple yet effective Forex scalping strategy on the 1-minute timeframe. This strategy is based on both trend-following and mean-reversing, which lowers the number of false signals to a minimum. Still, you need to apply strict risk management rules and only risk a small part of your trading account if you want to become successful in the long run.

You can use this trading strategy around the clock, but the best results are usually generated during volatile market conditions. That’s why I recommend to make the bulk of your scalping trades during the New York-London session overlap.

These few hours (from 8:00 AM to 12:00 PM EST) offer the lowest trading costs and highest liquidity which is very important to scalpers. Also, most US market reports are released early in the New York session, creating market volatility and increasing the profit potential of your trades.

The strategy uses two moving averages and one oscillator. Here’re the indicators and their setting that you need to apply to your chart:

- 50-Period exponential moving average

- 100-Period exponential moving average

- Stochastic oscillator with a setting of (5,3,3)

Strategy Overview

Let’s take a look at the 3 main steps of our 1-minute Forex scalping strategy.

Step 1: Identify the short-term trend

The two moving averages are used to identify the current trend in the 1-minute timeframe. The 50-period EMA calculates the average price of the past 50 minutes, while the 100-period EMA calculates the average price of the past 100 minutes. The 50-period EMA is faster than the 100-period EMA, which means that it reacts to price-changes more quickly.

If the faster 50-period EMA crosses above the slower 100-period EMA, this reflects that average prices are starting to rise and that an uptrend is likely to establish. Similarly, a cross of the 50-period EMA below the 100-period EMA signals that average prices start to drop and that a short-term downtrend is about to form. We’ll only take trades in the direction of the short-term trend.

Step 2: Wait for a pullback

Once we determine the short-term trend in the 1-minute chart based on the location of the slow and fast EMAs, it’s time to wait for a pullback to the moving averages. This step is important because prices tend to return to their mean value after a strong up- or down-move. Waiting for pullbacks prevents us from entering into long and short positions immediately after a strong price-change. Profit-taking activities often cause the price to reverse after a sustained move, which can lead to fake signals and losses.

Step 3: Wait for the stochastics indicator to move above/below oversold/overbought conditions

Finally, our stochastics indicator serves as the last filter and helps us take only high-probability trades. The Stochastics indicator is an oscillator that oscillates between 0 and 100, depending on the strength of recent price-moves. A reading above 80 usually signals that the recent up-move was too strong and that a down-move can be expected. This market condition is usually referred to as overbought.

Similarly, a reading below 20 signals that the recent down-move was too strong that an up-move may be ahead. This market condition is usually flagged as oversold. After the price completed a pullback to the EMAs, Stochastics will usually become overbought/oversold as a result of the recent price-move.

- Learn more, take our free course: Stochastics

Buy Setup Example

The following chart shows a buy setup generated by our 1-minute Forex scalping strategy. Let’s take a look at what happened in the chart, step by step.

- The 50-period EMA crossed above the 100-period EMA – The first arrow from the left shows a cross of the faster 50-period EMA above the slower 100-period EMA, signaling that the EUR/USD pair is entering into an uptrend in the 1-minute chart. As long as the faster EMA remains above the slower EMA, we’ll only look for buy opportunities in this chart, in order to only trade in the direction of the trend.

- Price returns to EMA and Stochastics move below 80 – The next two red arrows show the pullback to the moving averages. After the 50-period EMA moved above the 100-period EMA, Stochastics became overbought and the price started to make a pullback to the MAs.

- Buy signal – The pullback lowered the reading of the Stochastics indicator to below 20, signaling an oversold market environment. Once the Stochastics indicator moves above 20 again, our system triggers a buy signal.

- Take our free course: Technical Analysis Explained

- Take our free course: Trends, Support & Resistance

- Take our premium course: Trading for Beginners

- Take our free course: Japanese Candlesticks Decoded

- Take our free course: Reversal Price Patterns

- Take our free course: Continuation Price Patterns

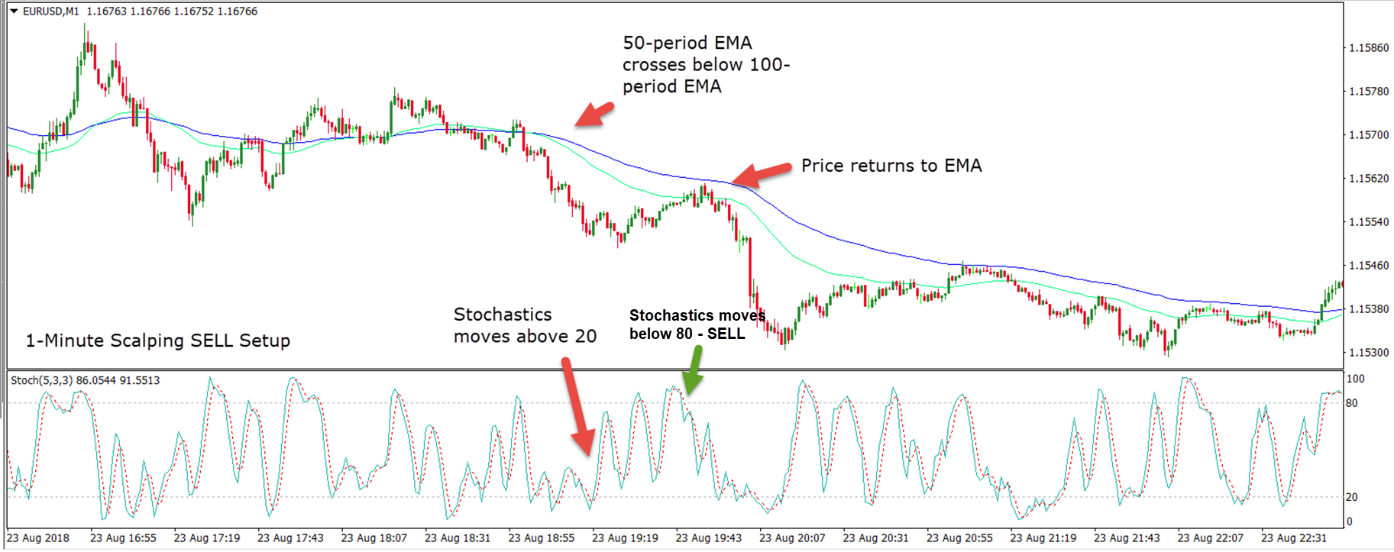

Sell Setup Example

The following chart shows an example of a sell signal generated by our 1-minute Forex scalping system. Again, let’s cover the main points of this sell setup example.

- The 50-period EMA moved below the 100-period EMA – This signals that the pair is entering into a downtrend as the average price of the last 50 minutes is sharply dropping. From now on, we’ll look only for short opportunities as long as the 50-period EMA stays below the 100-period EMA.

- Pullback – After the price finished its strong down-move, moving the Stochastics indicator to below 20 (oversold conditions), the price started to form a pullback to the moving averages. Simultaneously, the Stochastics oscillator crossed above 20, heading to overbought market conditions.

- Sell signal – After the price finishes its pullback and the Stochastics indicator moves below 80, indicating that the market isn’t overbought anymore, we can enter into a short position.

Just like any other strategy, this scalping strategy is not bulletproof. Once we identify a trend based on the EMA crossover rule, it’s important to note that the Stochastics oscillator may stay in overbought or oversold market conditions for considerable periods of time. This is especially true during very strong trends.

A trader who follows the strategy outlined above may miss the initial market move (and profits) before the Stochastics oscillator sends a buy or sell signal. However, we consider that this filter increases the likelihood of profitable trades in the long run. While we’ll miss some of the profits, the filter based on the Stochastics oscillator will reduce the number of fake signals significantly.

- Take our free course: Technical Analysis Explained

- Take our free course: Trends, Support & Resistance

- Take our free course: Japanese Candlesticks Decoded

- Take our free course: Reversal Price Patterns

- Take our free course: Continuation Price Patterns

- Take our premium course: Trading for Beginners

Discipline is key

Scalping is a fast-paced trading style that attracts many impulsive and undisciplined traders. Ironically, to master the art of scalping, a trader needs to be very disciplined. The main difference between scalping and swing trading are the timeframes involved in analyzing the market.

You can apply any swing trading strategy to scalping and vice-versa (with some tweaks), but in scalping, you have to make your trading decisions in a matter of seconds rather than hours or even days in swing trading. This makes scalping very difficult. If you’re not profitable on longer-term timeframes, why should you be a profitable scalper?

Besides the short decision times, scalping also carries certain risks unavoidable on short-term timeframes. You’ll likely encounter much higher trading costs than with swing or day trading, and market noise can have a significant impact on your bottom line.

FAQs About Scalping

What is Forex Scalping?

Forex scalping is one of the main trading styles in the Forex market, along with day trading, swing trading and position trading.

The main difference between scalping and the other trading styles is the trading timeframe and holding period of trades. Scalping is an extremely short-term and fast-paced trading style, where traders hold trades for a few seconds to a few minutes. In order to find such short-term trading opportunities, scalpers have to rely on very short timeframes, such as the 1-minute and 5-minute ones.

Many impulsive traders feel attracted to scalping, especially those who aren’t patient enough to wait for days for a trade to form on higher timeframes. Unfortunately, beginners often fall into this group of traders and start scalping the market, unaware of the risks that scalping carries.

Scalping isn’t easy. In fact, if you want to scalp the market successfully, you need to be an experienced trader. I usually recommend becoming consistently profitable with a day trading or swing trading technique before you move on to scalping.

Longer-term trading styles provide you enough room to analyse the market and avoid impulsive trades. You can look for trade setups from a safe distance when swing trading the market. Even if your analysis proves wrong, you can close a longer-term trade before it starts to make a large damage to your trading account.

Scalping doesn’t provide that luxury. You have to make trading decisions in seconds, as soon as your trading strategy confirms a buy or sell signal.

Learn More: What is Day Trading? (And The Main Styles)

Pros and Cons of Scalping

Scalping carries unavoidable risks which come with trading on very short-term timeframes. Scalpers face higher trading costs than longer-term traders since they open much more trades on a daily basis. In addition, market noise and news releases can easily turn a profitable trade into a loser or even hit your stop levels. Still, scalping can also be very profitable if you follow the rules and understand price-movements on short-term timeframes.

Here are the main advantages and disadvantages of scalping.

Advantages:

- Fast-paced environment – Scalping is a very fast-paced trading style, making it an ideal choice for traders who don’t want to wait for days to take a trade. There are always trading opportunities present on the 1-minute or 5-minute charts, and new setups arise as fast as old go. If you don’t have the patience to trade longer-term timeframes or want an exciting trading environment, then scalping may be the best trading style for you.

- Large number of trades – Scalpers usually take a very high number of trades during a day. It’s not uncommon to take dozens of trades on short-term timeframes if your trading system gives you the green light. A large number of trades also means a higher profit potential, given your analysis is correct and you close your trades in profit. This is why risk management is very important when scalping – you have to let your winners run, cut your losers short, and exit out of a scalping position as soon as there forms any sign of a reversal.

- Short holding period – Scalpers hold their trades for very short periods of time – from a few seconds to a few minutes. This means that there’s no overnight risk in scalping as is the case in swing trading for example. Scalpers know whether they’ve made a profit on a trade soon after they place a trade, which increases the attractiveness of scalping over other longer-term trading styles.

Disadvantages:

- High trading costs – Scalping doesn’t come without certain risks and disadvantages. The main disadvantage of scalping is the relatively high trading cost. Scalping allows us to open high position sizes as the stops are relatively close to the entry price. Higher position sizes mean higher transaction costs. Multiply that by the number of trades that scalpers take on a daily basis, and you’ll have to make a few profitable trades only to break-even. To avoid very high trading costs (wide spreads), you should focus on the most liquid market hours which provide the tightest spreads.

- Scalping requires the ability to focus – To become a successful scalper, you need to be able to put all your attention on the charts for several hours during a day. Unlike longer-term traders, scalpers need to manage their trades constantly as market conditions can change from minute to minute on short-term timeframes. Add the focus required to analyse the market and to pull the trigger as soon as a trade confirms, and you’ll soon realise that scalping requires nerves of steel.

- Market noise – Market noise is inevitable when trading on short-term timeframes with a scalping trading style. Market noise refers to sudden price-movements without an obvious cause and is usually the result of capital flows, investor repositioning and bank transactions that can move the market to a certain extent. If you place your exit targets too tight when scalping, chances are that market noise will stop you out of your position or miss your profit target.