Top 5 Economic Indicators in the Forex Market

News reports often have a tremendous impact on financial markets.

The currency market is no exception.

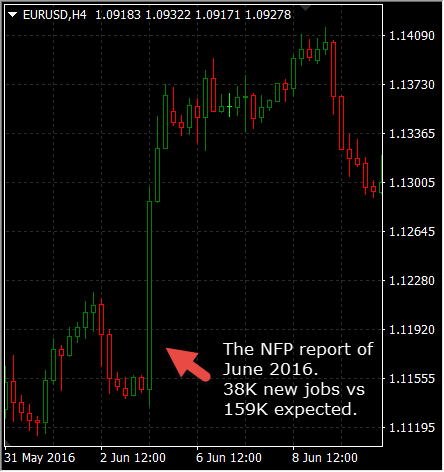

Unexpected news reports that miss market forecasts can send shockwaves through the market. They can also move exchange rates hundreds of pips.

Experienced Forex traders already know how important news reports can be. Many of them avoid trading during news releases altogether. But, are Forex reports that dangerous and is there a way to profit from the market volatility they create?

Let’s take a closer look at the reasons why market reports have a large influence on currencies.

Why are Forex News Reports Moving the Market?

Analysing the Forex market can be applied in various ways. The most popular is technical and fundamental analysis. Under this umbrella, market news and economic reports are part of the fundamental approach.

Fundamental analysis tries to measure the equilibrium exchange rate based on macro-economic statistics. This includes inflation rates, economic growth and labour data statistics. These factors tend to change gradually. This is why fundamental traders are more long-term traders compared to technical traders.

While the mentioned economic statistics are so-called macro-fundamentals, news reports are micro-fundamentals. These don’t move the market in the long run, but create a strong trading momentum immediately after release.

Their impact can sometimes last for a few days, creating a shorter-term trend in the market. In the long run, high-important market reports can change the macro-fundamental picture and start a long-term trend.

That’s why following market reports is so important for Forex traders.

They can create both short-term volatility only seconds after the release. They can also start a long-term trend if the broader fundamental picture changes.

Read:

- From Dawn to Dusk: A Day in the Life of a Trader

- Making the Big Bucks: How do you Become a Professional Trader?

- The Ultimate Day Trading Setup

[adinserter block=”3″]

Classification of News Reports and Economic Indicators

As you may have noticed, we use the terms news reports and economic indicators interchangeably, and that’s for a reason.

The term Forex news reports is a more colloquial term compared to the term economic indicators. The latter refers to important statistics about a specific economic activity.

In any case, a Forex economic calendar groups the most important news reports (or economic indicators) into an easy-to-follow table. Many of those calendars even sort the reports by their anticipated market impact.

Watch: What are economic indicators?

High-impact reports are usually marked with a red flag.

We mark medium-impact reports with orange and low-impact reports with yellow. In this article, we’ll focus on the red, high-impact economic indicators.

But first, let’s explain how we classify economic indicators.

We base the most popular classification on the current business cycle and the relationship that the indicators have with the cycle.

In this regard, we group indicators into leading, coincident and lagging economic indicators. Figuratively speaking:

- Leading indicators look through the windshield of a car

- Coincident indicators look through the side-windows

- Lagging indicators look at the rearview mirror

Leading economic indicators

Leading indicators often expect changes in the business cycle before they happen.

Policy makers often use leading economic indicators to make changes to their monetary or fiscal policy. This is to avoid a slowdown of the economic activity or recession. Examples of leading indicators are stock indices, retail sales, and consumer expectation surveys.

It also includes gold and oil prices, new housing starts and labour market statistics, to name a few.

Coincident economic indicators

Coincident indicators change with the business cycle. They provide a picture of how the economy currently performs.

Some of the most important coincident indicators are the gross domestic product (GDP) and industrial activity reports. It also includes trade balance, consumer and producer price indices (CPI and PPI) and personal income reports.

Lagging economic indicators

Last but not least, lagging indicators change once the business cycle has already changed.

They lag the current cycle for a few quarters and confirm that a new trend in the economy has established.

Examples of lagging indicators are:

- The unemployment rate

- Consumer surveys

- Company earnings reports

… to name a few.

Lagging indicators are often used together with coincident indicators as confirmation tools.

Read:

- Forex Charts Demystified: Charting Types Explained

- Identify Forex Chart Levels (And How to Trade Them)

- REVEALED: Support and Resistance Levels on any Chart

Top 5 News Reports in the Forex Market

Now that you know what news reports are and how they’re classified, let’s dig deeper.

If you want to gain a deeper understanding of economic indicators and boost your trading performance, take a look at our Forex courses at My Trading Skills. We offer a complete trading course both for beginners and experienced traders.

[adinserter block=”1″]

Labour Market Statistics

Labour market statistics are top of our list. For a reason.

They’re the most important market report to watch. Job creation and other labour statistics reveal a lot about the general condition of an economy. Policy makers and economists closely follow unemployment rates. The Fed even creates its monetary policy around labour numbers as one of its main inputs.

In developed economies, such as the United States, the United Kingdom or Japan, consumer spending accounts for around 70% of the total gross domestic product of a country.

A strong labour market, wage growth and low unemployment rates contribute to increased consumer spending. This in turn can lead to economic growth.

Since the US dollar involves itself in more than 80% of all Forex transactions, it’s no surprise that US labour market statistics have the largest impact on all major pairs. The US Bureau of Labor Statistics releases a wide range of labour reports each first Friday of the month.

This is at 8:30 EST. It includes Nonfarm payrolls (NFP), average hourly earnings and the unemployment rate.

Non-farm payrolls include all new jobs excluding self-employment, farm work, and certain government jobs.

Non-farm payrolls provide a valuable insight into how hiring managers at large companies view the current and upcoming market conditions. They’ll hire more if they expect an increased demand for their products.

They will hire less if the economic outlook is not so bright.

Gross Domestic Product – The Broadest Market Indicator

The gross domestic product, or GDP, is the broadest economic indicator of a country.

It includes the sum of market values of all finished goods and services produced inside the borders of a country within a specific period of time.

Most countries report on their GDP in three stages. The advance report, the preliminary report and the final report. The advance report is the first GDP report that hits the newswires. It tends to have the largest impact on the Forex market.

The preliminary and final reports are then released one and two months after the advance report. The US Bureau of Economic Analysis publishes the US GDP report on a quarterly basis. It begins with the advance report and finishes with the final report. This is during a three-month period.

[adinserter block=”3″]If the released GDP number is above market forecasts, the country’s currency tends to appreciate. Similarly, if the GDP number falls below market forecasts, the currency tends to depreciate.

As a quarterly release, traders try to expect future GDP reports by following and analysing reports on consumer expenditure and retail sales.

Inflation Rates

Inflation rates measure the change of prices in goods and services over a specific period of time. Just like labour market statistics and GDP reports, inflation data is a major market-mover in Forex.

Many central banks in developed countries, including the Fed and the Bank of England, have an inflation rate target. Policy makers try to meet their inflation target by tweaking monetary and fiscal policies.

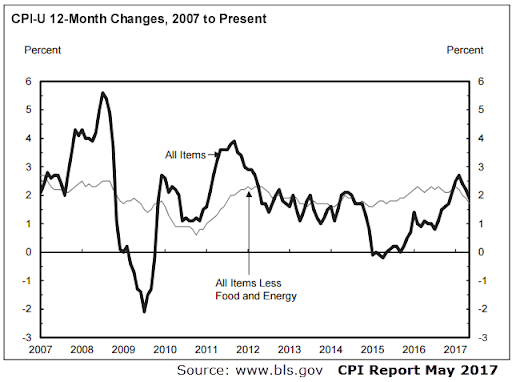

Many financial analysts and traders follow the implicit price deflator. This is released together with the GDP report. But, since the release of GDP is quarterly, traders look for other, more frequent reports. Such as the Consumer Price Index (CPI) and the Producer Price Index (PPI).

The Bureau of Labor Statistics release CPI and PPI around the middle of the current month to reflect previous month’s data. The CPI tracks changes in the prices of consumer goods and services. The PPI calculates price-changes in the manufacturing process of goods.

Because of this, the PPI report can expect changes in prices of consumer goods. Producers often push any price-increases in the manufacturing process to the end consumer.

Another important indicator that measure inflation is the Core CPI report. This report excludes volatile categories, such as food and energy. It paints to a more reliable picture of the impact of price-changes. As a result, the Core CPI chart is usually much smoother than the regular CPI report. We show this on the following graph.

We refer to extremely high inflation rates to as hyperinflation. They can have a devastating impact on the economy. High inflation rates which are a result of positive economic conditions are tackled by tighter monetary policies.

This prevents overheated economic conditions. While high inflation rates are not a good sign, negative inflation rates can have a similar deteriorating effect on economic activity. Many countries target a slightly positive inflation rate of around 2%, they consider this beneficial for the economy.

Read:

These Twitter Accounts Will Up Your Trading Game to the Next Level

Is it Worth Trading on Weekend? We Reveal All!

Get Serious: Trade Like a Hedge Fund Manager

Central Bank Meetings

Forex traders follow important central bank meetings for potential changes in their monetary policy. In the case of the US dollar, the Federal Open Market Committee (FOMC), which is a branch of the Federal Reserve, is in charge of the US monetary politics.

The main role of the FOMC is to execute open market operations. This should change the available money supply through the buying and selling of government bonds. If the FOMC buys government bonds, the increased money supply will lead to a looser monetary policy and lower interest rates.

Similarly, if the FOMC wants to tighten monetary policy and increase interest rates, it would sell government bonds and reduce the available money supply in the market. Since central bank meetings are generally secret in their character, many economic analysts try to expect their outcome.

Traders tend to stay on the sideline during those events.

Read:

Easy To Understand Price Action Trading

So, How Do You Actually Enter Price Action Trades?

Essential Guide to Fibonacci Levels for Traders

Retail Sales

One of the most important leading indicators available to Forex traders is the retail sales report. This report, published by the Department of Commerce in the US around two weeks after the end of the record month, measures the total value of sales in the retail sector.

As you already know, consumer consumption accounts for the largest part of a country’s GDP, and retail sales provide a valuable insight into consumption at the retail level. A high value of retail sales also leads to higher corporate earnings, which in turn can lead to more investments and the appreciation of the domestic currency.

Yet, the nature of retail sales makes them quite difficult to expect. In general, if surveys show a high optimism among consumers, the unemployment rate is low and the economy is doing well, people tend to spend more. Some analysts track the spending behaviour during major holidays, such as Christmas and Easter.

They then compare them with previous years’ reports to get a picture of how the economy is performing. As Richard Yamarone explains in one of his books:

“Analysts even go to shopping malls and count the number of free parking lots to predict the value of retail sales during holidays.”

Conclusion

Economic indicators and news reports often affect exchange rates immediately after they’re released. It’s not unusual for exchange rates to move hundreds of pips. Especially so if the actual released number differ to a large extent from market forecasts and Street expectations.

Despite being micro-fundamentals, market reports can have a long-lasting impact on the Forex market. They influence macro-fundamentals and the equilibrium exchange rate between two currencies. That’s why all types of enjoy understanding the concepts outlined in this article.

Short-term traders and scalpers can try to ride the high volatility that the release of these reports creates. Long-term traders can position themselves and tweak their Forex portfolio if market reports begin to affect underlying macro-fundamentals.

Recommended Reading:

Complete Forex Trading Guide for Beginners