What are Key Chart Levels and How to Trade Them

If you’re just starting out with trading and technical analysis, you need to cover the market’s foundations. Identifying key chart tools and knowing how to trade them plays an important role in your trading performance.

Support and resistance levels form the basis of many technical price-levels and are essential tools in any technical toolbox.

In this article, we’ll cover what key chart levels are, how to spot and trade them, and answer a few common questions that beginner traders have when it comes to support and resistance trading.

- Learn more, take our free course: Trends, Support & Resistance

What are Key Chart Trading Levels?

Key chart levels are important technical levels at which a financial instrument could face increased buying or selling pressure.

Traders look out for key chart levels to place their buy and sell orders around those lines, which accelerates price-moves and increases volatility when the price reaches those levels. Typically, key chart levels are identified by support and resistance lines, which act as barriers for the price when reached from the upside or downside, respectively.

Support levels are price-lines at which the market had difficulties to break below, signalling that buyers may join the market again if the price falls to a key support level. Resistance levels are quite similar to support levels, only that they form to the upside and signal price-levels at which the market had difficulties to break above.

When the price reaches a key resistance level, sellers may jump into the market and send the price lower again.

Read:

Types of Support and Resistance Levels

There are many types of key chart levels which act as important support and resistance levels in the chart. We’ve outlined the most common ones in the following lines.

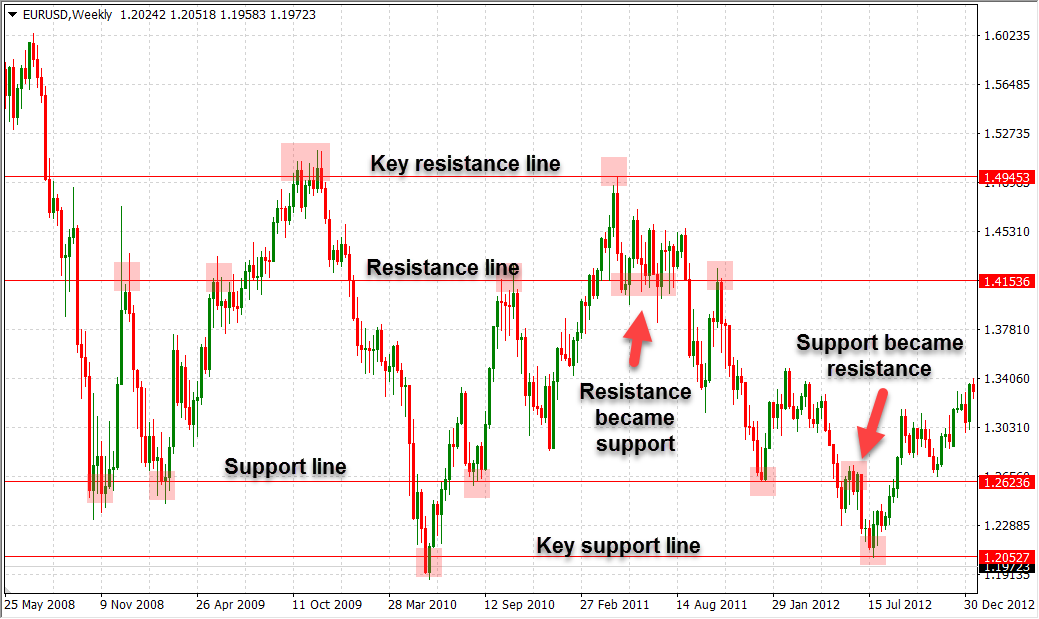

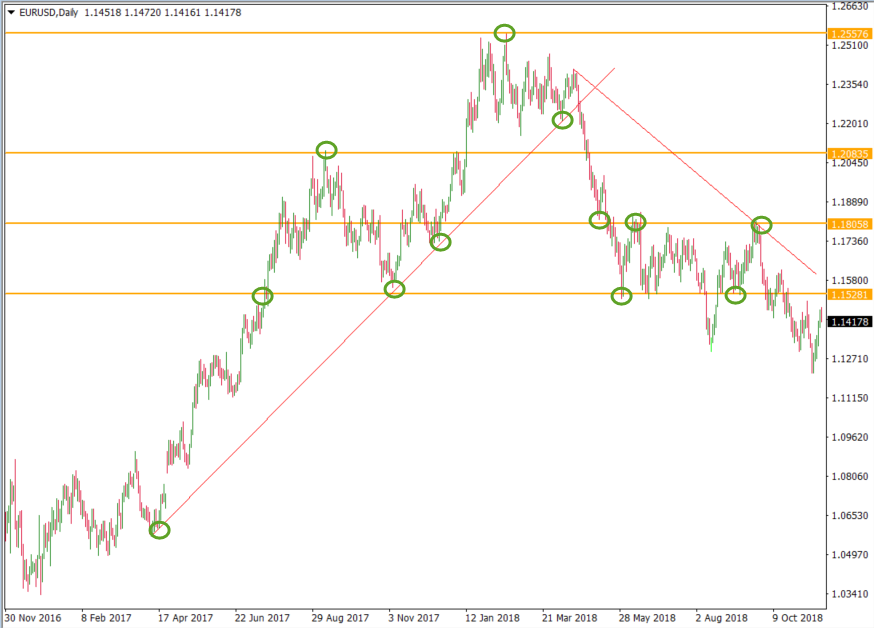

1. Horizontal key chart levels: As their name suggests, these are horizontal levels which are placed at the top of a previous swing high, or at the bottom of a previous swing low. Horizontal key chart levels are then projected into the future to mark price-levels at which the market may retrace, as shown on the following chart.

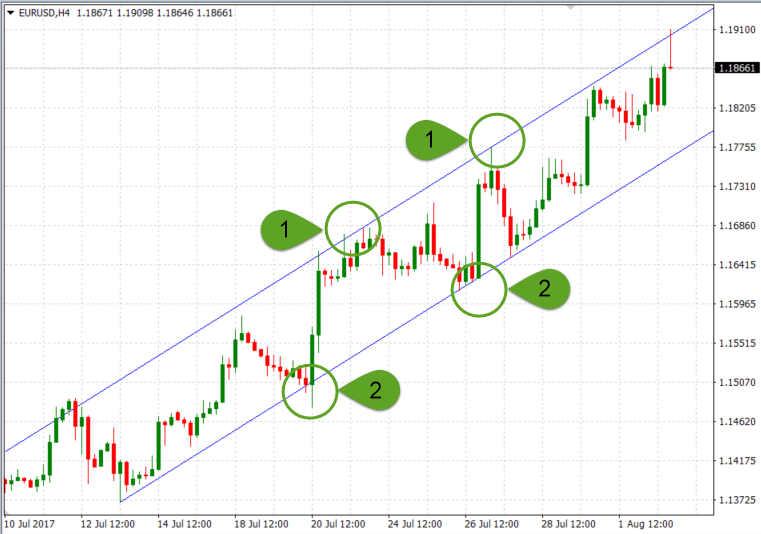

2. Non-Horizontal Key Chart Levels: Besides horizontal key levels, traders can also draw trendlines and channels which don’t have to be horizontal in order to act as key support and resistance levels. Trendlines and channels are commonly used in Forex trading to spot uptrend and downtrends and ride the trend. The following chart shows how trendlines and channels could act as important turning points for the price.

Points (1) and (2) acted as resistance and support for the EUR/USD pair, respectively, identified by a simple rising channel. Just like with rising channels, the lower boundaries of a downward sloping channel act again as support levels, while the upper boundaries act as resistance levels for the price. Channels are quite similar to trendlines, only that they include a second trendline which is drawn parallel to the first trendline.

3. Round-Number Key Chart Levels: These levels form around round-number exchange rates, such as 1.00, 1.50, 0.50, 1.25 etc. The psychology of market participants shows that traders tend to place their market orders around round numbers, increasing the buying or selling pressure around those levels.

4. Dynamic Key Chart Levels: Last but not least, dynamic key chart levels change with each new price-tick. They’re usually drawn automatically by your trading platform by applying specific technical indicators, such as moving averages or pivot points.

- Learn more, take our free course: Pivot Points: Fast Track

Read:

How to Trade Support and Resistance

If you’re serious about your career as a trader, you need to learn how to trade support and resistance levels early in your trading career.

Not all support and resistance levels work the same or produce trade setups with equal probability of success. Here’re some pro tips on increasing the likelihood that a trade based on key support and resistance levels becomes a winner.

Pro Tip #1: Use higher timeframes to mark key support and resistance levels

Higher timeframes are more reliable when it comes to trading key chart levels, because a larger number of market participants pays attention to those levels. That’s why you should focus on higher timeframes, such as the daily and weekly ones, and bear in mind that support and resistance levels on timeframes lower than the 4-hour one could produce a lot of fake signals.

Pro Tip #2: If you miss a break of a key chart level, wait for a pullback to get into a trade

Pullbacks refer to a retest of a broken support or resistance line before the price continues in the direction of the breakout. Pullbacks work because support and resistance levels change their roles once broken. A broken support level becomes a resistance level, and a broken resistance level becomes a support level in future trading. This is shown on the following chart.

The horizontal level marked with point (1) acted as a support for the price at point (2). After the horizontal support was broken, the same line provided resistance for the price at points (3) and (4), signalling potential short setups.

- Take our free course: Technical Analysis Explained

- Take our free course: Trends, Support & Resistance

- Take our premium course: Trading for Beginners

- Take our free course: Japanese Candlesticks Decoded

- Take our free course: Reversal Price Patterns

- Take our free course: Continuation Price Patterns

Key Levels Identified by Channels and Trendlines

Channels and trendlines are essential tools in any technical trader’s toolbox. They are used in finding uptrends and downtrends in the market by connecting higher lows in uptrends and lower highs in downtrends. Again, try to focus on higher timeframes when using trendlines and channels in trend-following trading strategies, as market trends tend to be more predictable in the medium and long-term than on an intraday basis.

[adinserter block=”1″]Deutsche Bank published a great research paper on the Forex market and asked FX dealers to rate the predictability of market trends in the short, medium and long run. The table below shows the results:

| FX Dealers’ Perception of the Predictability of Exchange-Rate Movements | |||

| FX Dealer Survey Question—On a Scale of 1 to 5, Indicate If You Believe the Market Trend Is Predictable on an: | |||

| Intraday Basis | Medium-Run Basis (up to 6 months) | Long-Run Basis (beyond 6 months) | |

| 1 (Least Predictable) | 21.6% | 5.9% | 17.2% |

| 2 | 40.3% | 20.7% | 16.4% |

| 3 | 26.9% | 43.0% | 30.6% |

| 4 | 9.0% | 18.5% | 20.9% |

| 5 (Most Predictable) | 2.2% | 11.9% | 14.2% |

| Source: Yin-Wong Cheung, Menzie D. Chinn, and Ian W. Marsh,

“How Do UK-Based Foreign Exchange Dealers Think Their Market Operates?”, NBER Working Paper 7524, February 2000. Adapted from: Deutsche Bank Guide to Exchange Rate Determination |

|||

As the table above shows, FX dealers believe that market trends are most predictable in the medium-term and long-term. The majority of FX dealers (40.3%) believe that market trends are extremely difficult to predict on an intraday basis.

That’s why using support charts and resistance charts that include a few months of data are likely to produce better results than shorter-term charts.

Support and Resistance FAQ

Let’s take a look at a few common questions regarding support and resistance trading.

How to Trade Moving Averages as Support and Resistance

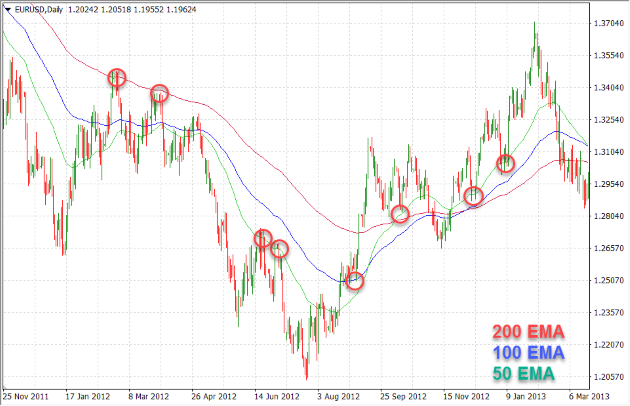

Moving averages can act as a great support and resistance indicator. Moving averages are a technical indicator which takes the average price of the last n trading periods and plots it on the chart. While simple moving averages give an equal weight to all trading periods included in their calculation, exponential moving averages give more importance to the most recent price-data.

The following chart shows how 50-period, 100-period and 200-period EMAs can work as dynamic support and resistance levels for the price. The 200-day EMA is especially important and followed by a large number of traders. The scenarios of the price testing dynamic S&R levels drawn by EMAs are shown in red circles.

- Learn more, take our free course: How to Use Technical Indicators

How to Trade Support and Resistance Zones on 15-Minute Trades

Many retail traders focus on day trading, especially in the beginning of their career. Short timeframes such as the 5-minutes or 15-minutes ones are often used by these traders to get the thrill that day trading provides. That said, trading on such short timeframes can often lead to costly mistakes and the accumulation of losses.

As Elder Alexander puts it in his famous book, Come Into My Trading Room,

“… the great paradox of day-trading is that it demands the highest level of discipline, while attracting the most impulsive, addictive, and gambling-prone personalities. If trading is a thrill, then day-trading provides the best rush. It is a joy to recognise a pattern on your screen, put in an order, and watch the market explode in a stiff rise, stuffing thousands of dollars into your pockets. A former military pilot said that day-trading was more exciting than sex or flying jet aircraft.”

To increase the likelihood of profitable trades, first mark key support and resistance levels on higher timeframes, such as the 4-hour and daily ones. After this, zoom-in to the 15-minutes charts to trade on shorter-term support and resistance levels.

Whenever the price reaches towards the longer-term, but the 15-minutes chart sends an opposing trading signal, your best bet would be to stay away from trading.

Read:

How to Set Support and Resistance Lines on MetaTrader 4

As one of the most popular trading platforms for retail Forex traders, chances are you’re using MetaTrader 4 or 5 as your primary trading software. The good news is that it’s easy to set support and resistance lines on the MetaTrader 4 platform.

Follow these steps:

Step 1: Open the currency pair that you want to analyse

Step 2: Select the 4-hour or daily timeframe to draw key support and resistance levels first

![]()

Step 3: Identify obvious swing highs and lows and draw a horizontal line on them. In the case of a price trending, use trendlines or channels to connect the highs or lows

![]()

Step 4: Zoom-in to shorter-term timeframes and repeat step 3 to find entry and exit points, or keep trading from the longer-term timeframes to get trade signals with higher probabilities of success.

![]()

Read:

When all is said and done, key chart trading levels are important

Despite the fact that these levels form the foundation of many technical tools, they’re relatively simple to identify and trade. Many trend-following trading strategies rely on key chart levels to spot areas of major buying and selling pressure.

This is done by using trendlines and channels. If the price reaches a channel’s boundaries, there is a high chance of a price correction or reversal.

- Learn more, take our free course: Reversal Price Patterns

Learning the ins and outs of trading key chart levels is best achieved by studying financial trading, experience and screen time.