A Lowdown on Forex Robots (And Do They Really Work?)

In the early years of trading, traders had to do everything manually. A paper and a pencil were the main tools of chartists, and fundamental traders relied on daily newspapers to make trading decisions. Fortunately, times have changed and the advance of technology hasn’t brought us only online trading, but also trading robots.

What are trading robots and do they really work? Let’s find out.

What are Forex Robots?

Forex trading robots, also called automated trading systems, are computer programs that do all the hard work for you – they analyse the market, open, manage and close trades for you. Those programs differ in the complexity from very simple programs with a few lines of code to institutional algo-robots that are immensely complex.

Still, both the simple and the complex Forex robots mostly rely on mechanical trading rules to spot trading opportunities in the market. These rules range from simple MA crossovers (i.e., buy when the 50-period MA crosses above the 200-period MA) to very difficult algorithms that take both technical and fundamental data into account.

Using Forex trading is quite easy for retail traders as most retail trading platforms offer that feature. All you have to do is download the robot trading file (called Expert Advisor in MetaTrader 4/5) and add it to your trading platform.

The file contains a set of rules and, once enabled, scans the market for trading opportunities with each new price-tick. It runs its calculation over and over again until its algorithms return a buy or sell signal. Since most Forex trading robots use technical indicators in the computation, they will also use the current value of the indicator to determine whether a trading opportunity exists.

- Learn more, take our free course: How to Use Technical Indicators

There are thousands of trading robots to choose from that are compatible with the most popular retail trading platforms. While many of them are free, there are also paid versions with extremely high price tags. Bear in mind that the higher price doesn’t mean that the robot will have better trading results.

Whichever robot you use, you should first backtest its performance using past price-data before letting it work with your real trading account.

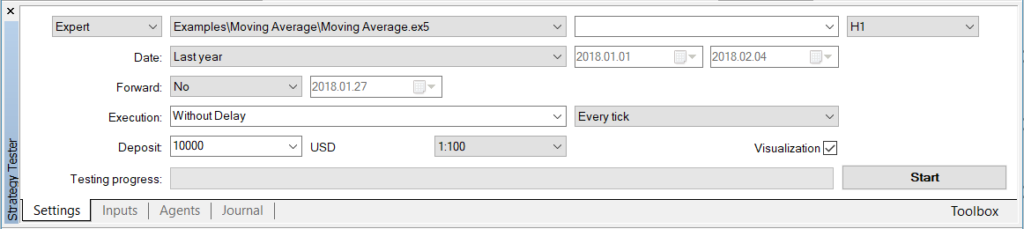

Expert Tip: MetaTrader has a handy feature called Strategy Tester that allows you to backtest your trading robot with different inputs. You can access it with the keyboard shortcut CTRL + R

Read:

Do You Know Which Questions to Ask a Forex Trading Coach?

Why Some Day Trading Courses are Complete *&$!**!%^

15 Forex Terminologies You Can Live By

How Do Forex Robots Work?

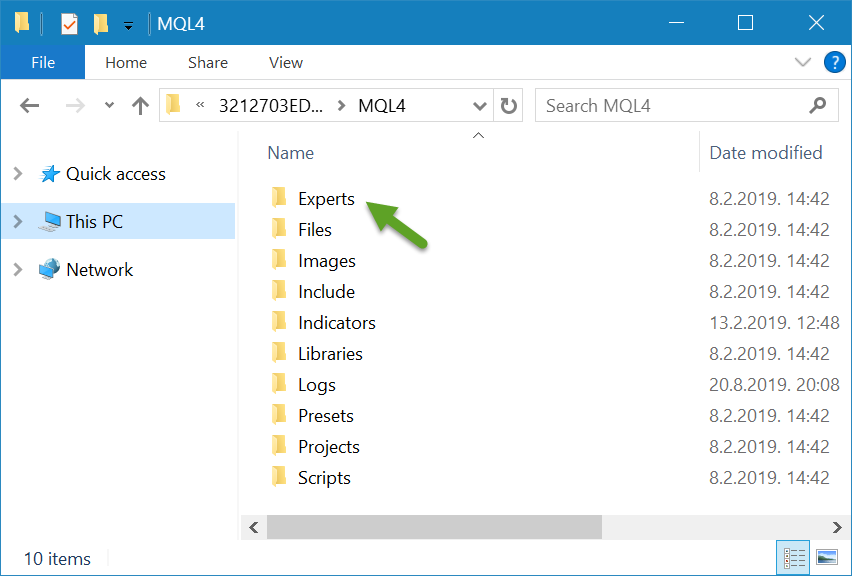

Forex trading robots use mechanical trading rules to identify potential trade setups. Before a robot is able to scan for trades, you need to download it to your hard-drive and enable it in your trading platform.

If you’re using MetaTrader, all you need to do is download the *.ex4 file (the trading robot) and move it to the “Experts” folder inside your MetaTrader installation folder. Restart your trading platform, and you’ll find your new robot in the Navigator window of MetaTrader. Simply drag-and-drop it to your chart to activate it.

Since robots are computer programs, they need to be developed and programmed by programmers. MetaTrader uses the MQL programming language which is based on other popular programming languages and is quite easy to learn, especially if you have a programming background.

Here’s an example of how a Forex trading robot could be programmed to find trading opportunities. The following chart shows the EUR/USD pair on the 5-minute timeframe with the ADX indicator applied below the chart-window.

The ADX (Average Directional Movement Index) is a trend-following indicator that consists of three lines: the +DI line, the –DI line, and the ADX line. If the ADX line has a value higher than 25, the market is trending. Values higher than 50 and 75 signal strong trends and extremely strong trend, respectively.

If the +DI line is above the –DI line, the trend is up. And if the –DI line is above the +DI line, the trend is down. With all this information, we could write a simple Forex robot in MQL with the following algorithm:

- If the ADX is above 25 and +DI is higher than –DI, then BUY

- If the ADX is above 25 and –DI is higher than +DI, then SELL

- If the ADX is above 50 and +DI is higher than –DI, then BUY and INCREASE POSITION SIZE

- If the ADX is above 50 and –DI is higher than +DI, then SELL and INCREASE POSITION SIZE

- If the ADX is BELOW 25, then DON’T TRADE

These five simple rules are enough for the Forex robot to understand what to look for in the market. It will run its calculation with each new price-tick, following the rules above, and open trades if the rules are met.

A complete trading robot would also have additional rules for locking in profits and cutting losses.

You could also do this manually, but it would be very time-consuming and you’ll likely miss some of the trade setups.

Expert Tip: If you’re interested in creating your own trading robot in MQL, take a look at this MetaQuotes tutorial.

Read:

REVEALED: Secret Ways You Can Make Money Day Trading

101 Guide to Understanding Forex Signals

A Handy Guide to Get To Grips With Short Selling Currencies

Which Strategies Do Robots Use?

Trading strategies used by Forex robots range from trend-following strategies to strategies used in sideways-moving markets.

Trend-following trading robots aim to open a trade in the direction of the overall trend – if the market is in an uptrend, a trend-following robot would look for buying opportunities, similarly, markets in a downtrend would trigger sell orders.

Trend-following robots are mostly based on indicators that follow the trend, such as the ADX indicator mentioned above. Other popular technical indicators that are used by trend-following robots are moving averages and MACD.

Trading robots designed for ranging or sideways-moving markets have a different approach – they look to buy when the price becomes heavily oversold or reaches an important support level and to sell when the price becomes extremely overbought or reaches an important resistance level. To accomplish that, these types of trading robots rely on oscillators such as the Relative Strength Index (RSI) and Stochastics, to name a few.

- Learn more, take our free course: Relative Strength Index: Fast Track

-

- Learn more, take our free course: Stochastics

The main disadvantage of trend-following robots is that the underperform in ranging markets and can even return a heavy loss. The same is true when robots that are designed for ranging markets are applied to a trending market.

Read:

Top 10 TradingView Profiles You Must Follow

Best 15 Trading Twitter Accounts in 2019

9 of the Best Forex Trading Books You Should Keep on Your Bedside Table

Pros and Cons of Forex Robots

Trading robots have obvious advantages. If designed correctly, they save a lot of time for traders who would otherwise have to manually scan for trading opportunities.

Still, most Forex trading robots are still inferior to an experienced human trader. Most of the time, markets are too complex to be described by a set of rules. Market environments change periodically, and a robot that returned spectacular results in the past may suddenly stop working.

Occasionally, Black Swan events hit the market, and while an experienced trader may stand at the sideline during those times, a robot may continue to look for trade setups and enter into trades.

Pros:

- Automated trading – The main advantage of trading robots is their automated trading ability. All you have to do is to install the robot, and you’re ready to go. Let the computer script do all the hard work for you.

- Time-Saving – Automated trading saves a lot of time. A well-written trading robot takes care of all elements of trading – it scans for trade setups, evaluates the risk of trades, opens, manages and closes trades and knows where to exit them to maximise profits.

Cons:

- Trading Strategy – One of the main disadvantages of trading robots arises from their trading strategy. Trend-following robots work great in trending markets but underperform in a ranging market. Robots designed for ranging markets return good results until the market starts to trend. To minimise this disadvantage, look for robots that have strict risk management rules in place.

- Risk Management – Talking about risk management, trading robots will open trades whenever their algorithm sends a buy or sell signal. An experienced trader, looking at the chart, may avoid trading if there are important market news scheduled for the day, for example.

Best Forex Robots Software

Most popular trading platforms offer automated trading capabilities and support trading robots. Some of the most popular ones are MetaTrader 4/5 and NinjaTrader.

MetaTrader 4/5 is perhaps the most popular trading platform for retail traders. The MQL programming language is powerful and easy to learn, and the new MetaTrader 5 offers some welcoming improvements in the Strategy Tester over the MetaTrader 4 version, including multi-threaded and multi-currency backtesting using real price-ticks.

NinjaTrader uses a NET-based developing framework which allows developers to code add-ons and trading robots in C#. Similar to MetaTrader, NinjaTrader has a built-in strategy tester that allows for powerful backtesting of trading robots. The platform offers over 80 individual metrics and technical indicators that can be integrated into a trading robot.

Top Tips on Choosing a Robot

Not all trading robots are the same. Besides the trading strategy that they’re programmed to use, robots differ in the way how they manage risk, where they place stop-loss and take-profit orders, whether they add to winning positions and in many more ways. Here’re some top tips when choosing a trading robot.

- Choose a Robot that Fits Your Trading Style

This is probably the most important tip when choosing a robot. You need to have faith in your robot’s trading style. If you like to follow trends, then choosing a counter-trend trading robot doesn’t make much sense.

Similarly, if you’re a swing trader and like to hold your trades open for a few days or weeks, then don’t look for robots that are scalping the market.

Every robot will have periods when it doesn’t return the wanted results. Market conditions change, and no matter how complex and well-designed a trading robot is, there will be losing trades.

You need to stick to your robot and believe in its underlying strategy. Trading results will come in the long run – don’t judge your robot on the short-term.

- Understand How the Robot Works

It’s important to understand how your robot analyses the market, what are the robot’s main inputs and how it makes trading decisions. If its logic seems fuzzy, look for another robot.

Trading robots are designed to make automated trading decisions on the basis of a pre-programmed algorithm. If you don’t like the idea that your robot uses 10 technical indicators in its trading, then don’t use it. There are plenty of other trading robots on the market.

- Look for Robots That Have Built-In Risk Management

Since a trading robot opens, manages and closes trades for you, it should have strict and well-defined risk management rules.

Some robots are designed for aggressive trading – they open large position sizes with tight stop-losses and aim for a relatively large return on each trade. However, losses can also be quite high. You and your trading robot should have similar risk tolerance.

Read:

Forex Risk Management Tools You’re Better Off With

Tips on Using Forex Robots

Once you’ve found a Forex robot that fits all your needs in terms of trading style, strategy, and risk management, it’s time to put it to work. But wait, here’re a few tips on how to increase your robot’s performance.

- If Necessary, Use a VPN

Trading robots are add-ons to your trading platform. It’s your platform that executes the robot’s script, opens and closes trades. This means that when you close your platform and shut down your computer, the trading robot won’t be executed and can’t scan the market for trading opportunities.

Fortunately, a VPN can help in this situation. Virtual Private Networks enable users to send and receive data even if their computer isn’t working. If you want that your robot works 24 hours a day for you, consider using a VPN.

- Optimise the Forex Robot

Forex robots come with default settings. If they’re using technical indicators, for example, the indicators’ parameters will be set at a pre-specified value.

Most robots also allow changing other important parameters, such as the stop-loss size, take-profit size, and the maximum number of simultaneously open trades. Try to tweak your robot’s parameters to see what values return the best results.

- Back-Test the Robot Before Real Trading

Finally, always back-test a robot before letting it trade with real money. If you’re using MetaTrader, open the Strategy Tester, select your preferred timeframe and currency pair and see how the robot performs on historical data.

However, bear in mind that good past performance doesn’t mean that the robot will continue to return good results in the future.

Forex Robot Scams

Trading robot scams are mostly related to paid versions of robots. Scammers often use fake trading results to attract new customers, promising spectacular profits.

Here’re a couple tips on how to avoid robot scams.

- Always look for verified trading results – Trading results verified by third-party providers, such as myfxbook.com, make sure that the results advertised are results actually achieved.

- Don’t have unrealistic expectations – Robots that claim thousands of dollars of profits with a $100 trading account are probably fake. If the claimed profits are too good to be true, you’re likely dealing with a scammer.

Final Words: Do Forex Robots Really Work?

Forex robots are automated trading programs that scan the market for trading opportunities, open trades, manage and close them without the interference of a human trader.

While robots save a lot of time, they don’t come without certain drawbacks. The most notable disadvantage of trading robots is their inability to adjust to changing market conditions. A trend-following robot will fire buy signals in times when a robot designed for ranging markets opens sell signals and vice versa.

Oscillators become overbought during strong uptrends, sending sell signals, and oversold during strong downtrends, sending buy signals. It’s important to understand how your trading robot works to avoid fake signals and potentially large losses.

Do Forex robots really work? If a robot is used in a market condition it’s designed for, then yes. It’s the job of the trader to match the current trading environment with the right robot.