MT4 vs MT5: Which Should You Use?

Online trading is now more accessible than ever before. But, in order to start trading on your favourite financial market, you’ll need to install a trading platform on your laptop or smartphone.

While there are dozens of trading platforms out there, MetaTrader has proved to be one of the most popular platforms for retail traders. It’s robust, offers great features and has a large online community that is always available for help.

What’s even more important – most online brokers support MetaTrader. Simply download it, install, enter your username and password and you’re ready to go.

- Learn more, take our premium course: Trading for Beginners

Brief History of MetaTrader

The company behind MetaTrader, MetaQuotes Software, was founded in 2000 when it launched its first web-based trading platform named FX Charts. In 2001, the product was renamed MetaQuotes, and version 3 was released in 2002.

MetaTrader 4 was released in 2005 and represented a major overhaul of the software. The company added support for trading robots with the introduction of the MetaQuotes Language 4 (MQL4) and also made a mobile version of the MetaTrader 4 the same year.

For the next 10 years, MetaTrader 4 became the most popular retail trading platform and the main product of MetaQuotes Software. A new version of the platform called MetaTrader 5 was released in 2010, but the lack of backward compatibility made the uptake of MT5 rather slow among brokers.

Nowadays, an increasing number of brokers is adding support for MetaTrader 5 which offers noticeable advantages over its predecessor, MetaTrader 4. In the following lines, we’ll cover the most important differences between the two trading platforms.

Trade on Major Financial Markets with MT5

Initially, MetaTrader 4 was designed to support the Forex market only. However, as brokers had been adding more and more markets to their list of financial instruments, the trading platform had also to be expanded.

MetaTrader 5 offers support for all major markets, including Forex, futures, options, stocks, and bonds. In addition, the number of supported symbols is now unlimited, while MetaTrader 4 supported a maximum of 1024 tradable instruments.

This is an important upgrade in the new version of the platform as traders can follow more markets and take advantage of hedging strategies in MetaTrader 5.

MT5 Features Better Charting Tools

Most retail traders heavily rely on technical analysis, which makes the available charting tools an important factor when deciding between MetaTrader 4 and MetaTrader 5.

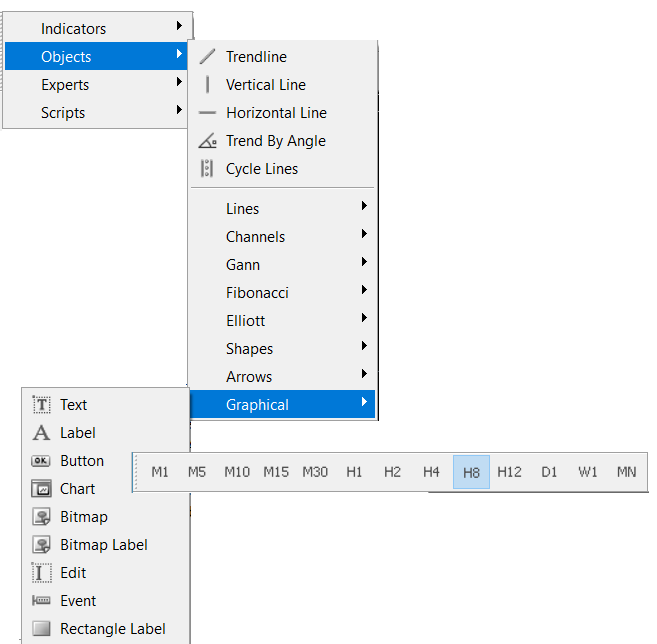

Both MetaTrader 4 and MetaTrader 5 feature great charting tools. MetaTrader 4 comes with a built-in library of 30 technical indicators and 31 graphical objects, including the widely-popular Relative Strength Index, Stochastics and Bollinger Bands.

There are 9 timeframes to choose from, starting from the very short-term 1-minute chart to monthly charts. Traders who use the MetaTrader 4 platform can also apply rectangles, horizontal and vertical lines and other graphical objects with a single mouse-click.

However, MetaTrader 5 takes charting to another level. The new version of the platform features 38 technical indicators and 44 graphical objects that can be applied to 21 timeframes.

Besides the ordinary timeframes, MT5 also features 2-hour charts, 8-hour charts and 12-hour charts that can come very handy for day traders and swing traders who want to analyse the market from different angles.

Both platforms allow traders to fully customise their charts, including the background colour, the colour of bearish and bullish candlesticks, border colours and more. This can be done in the Properties window of the chart (right-click anywhere in the chart area.) Traders can also choose between different types of price-charts in both platforms, including line charts, candlestick charts, and bar charts.

- Learn more, take our free course: Stochastics: Fast Track

- Learn more, take our free course: Bollinger Bands: Fast Track

New Order Filling Policies in MT5

The MetaTrader 5 platform has new order filling policies that allow you to set additional execution conditions before opening a trade. While MetaTrader 4 only supports “Fill or Kill” policies, MetaTrader 5 comes with additional order fill policies “Immediate or Cancel” and “Return”.

The new partial order filling policies ensure that trades are always filled by the currently available volume, while unfilled orders are being canceled.

MT4 vs MT5: Pending Orders Overview

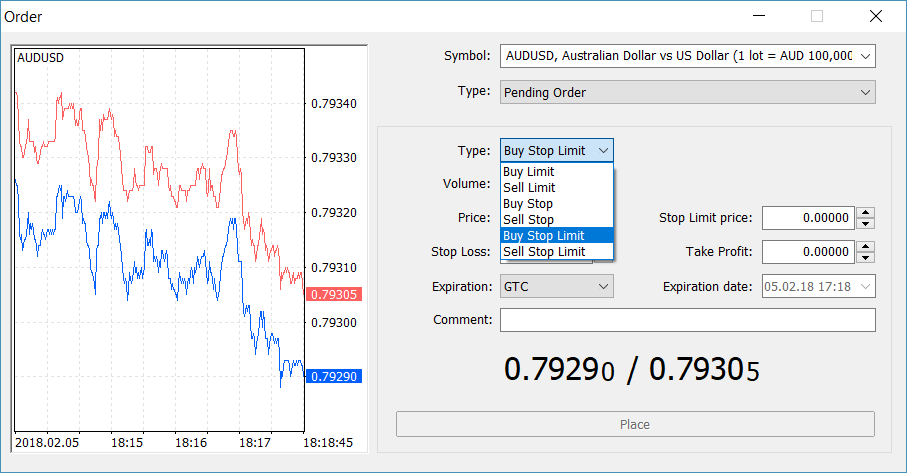

Pending orders are an extremely powerful tool for any type of traders. Besides market orders that are executed at the current market price, traders can also set a pending order that is executed only after certain conditions are met.

Popular pending order types include buy stops, sell stops, buy limits and sell limits.

Buy stops become buy market orders when the price reaches a pre-specified price level. For example, a trader could place a buy stop order when he expects a breakout to the upside. Instead of waiting for the breakout to occur, a buy stop order would simply sit and wait until the price reaches the pre-specified price (above the current market price), after which it becomes a market order.

Sell stops are identical to buy stops, only that they’re used when a trader expects a fall in the price. Sell stops become sell market orders when the pre-specified price is reached.

Buy limit and sell limit orders are often used by traders who anticipate an upcoming trend reversal. For a buy limit order to become a buy market order, the price has to fall below the pre-specified price and reverse to the upside again. Similarly, for a sell limit order to become a sell market order, the price has to rise above the pre-specified price and then reverse to the downside again. At the second cross, limit orders become market orders.

All four pending order types are available in the MetaTrader 4 platform. However, the MetaTrader 5 platform supports two additional pending orders: buy stop limit orders and sell stop limit orders. These pending orders are a combination of stop and limit orders and are usually used by experienced traders.

Built-In Economic Calendar

Economic calendars offer an overview of major economic events and market reports for the day. Many traders use economic calendars on a daily basis to check which stocks or currencies could experience a rise in volatility.

Wouldn’t it be handy to have an economic calendar integrated directly into your trading platform? The MetaTrader 5 platform comes with a built-in economic calendar that ensures that you stay up-to-date on major economic events at any time. You can check the time of the report, the instrument that is likely to be impacted, the event’s importance, forecasted numbers, previous numbers, and actual numbers.

The built-in MT5 economic calendar is a welcoming feature for fundamental traders and technical traders alike.

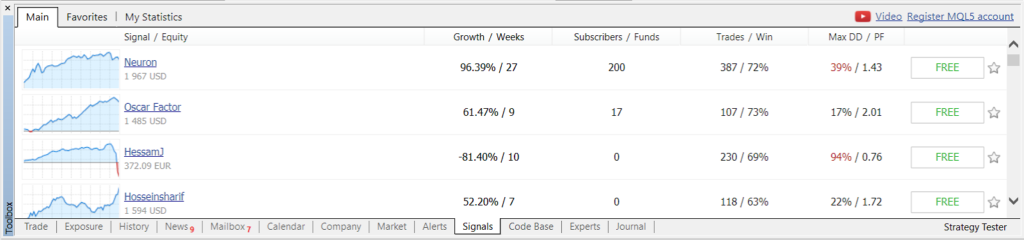

MT4 vs MT5: Marketplace Overview

Both MT4 and MT5 come with an integrated marketplace that allows you to buy or rent technical indicators or signal subscription services directly in the platform. MetaTrader 5 has an upgraded marketplace that comes with more customisation options for auto-trading. For example, you can set certain limitations based on your trading account size or prevent auto-trading in times of high slippage.

Upgraded Strategy Tester in MetaTrader 5

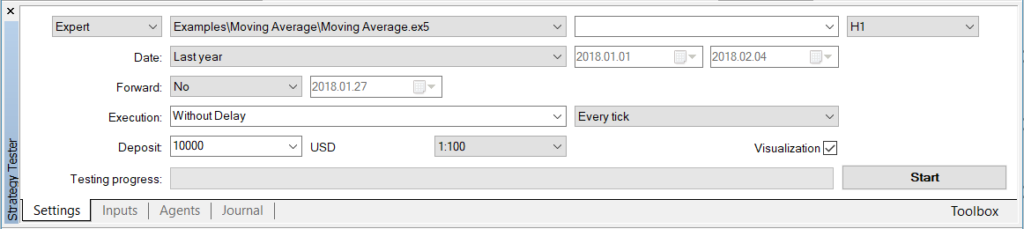

If you’ve ever used Expert Advisors, you know how important back-testing can be. MetaTrader 4 has an integrated Strategy Tester that allows only single-threaded backtesting. The new version of the platform, MetaTrader 5, now supports multi-threaded backtesting with multiple currencies and uses real price-ticks instead of closing prices only.

Expert Tip: To access the Strategy Tester in MT4 or MT5, use the keyboard shortcut CTRL + R.

Other Improvements

Besides the differences between MT4 and MT5 mentioned above, there’re some other improvements which could make life easier for traders. MetaTrader 5 now features Depth of Market (DoM) and allows you to transfer funds between different trading accounts.

There’s also an improved e-mail system that now supports attachments, an embedded MQL5 community chat, and multilingual interface support.

Final Words

Since its release, MetaTrader 4 has become one of the most popular trading platforms for retail traders. The majority of brokers have embraced the trading platform which has become the standard for online trading.

The MetaTrader 5 platform comes with noticeable improvements over the older version, including support for more financial markets, additional charting tools, more pending order types, new order filling policies, improved marketplace, and Strategy Tester to name a few.

Unfortunately, the lack of backward compatibility made the uptake of the new version by retail brokers a slow process. Today, an increasing number of brokers is adopting MetaTrader 5 which makes it an easier decision to switch to the new and upgraded trading platform.