Chapter 12

Spread Bet Examples

A couple of financial spread bet examples will help you clearly understand just how spread betting works.

Although there are different types of financial spread bets – daily funded, rolling daily bets and futures – a trader is entering them with a single, clear objective: to make a profit.

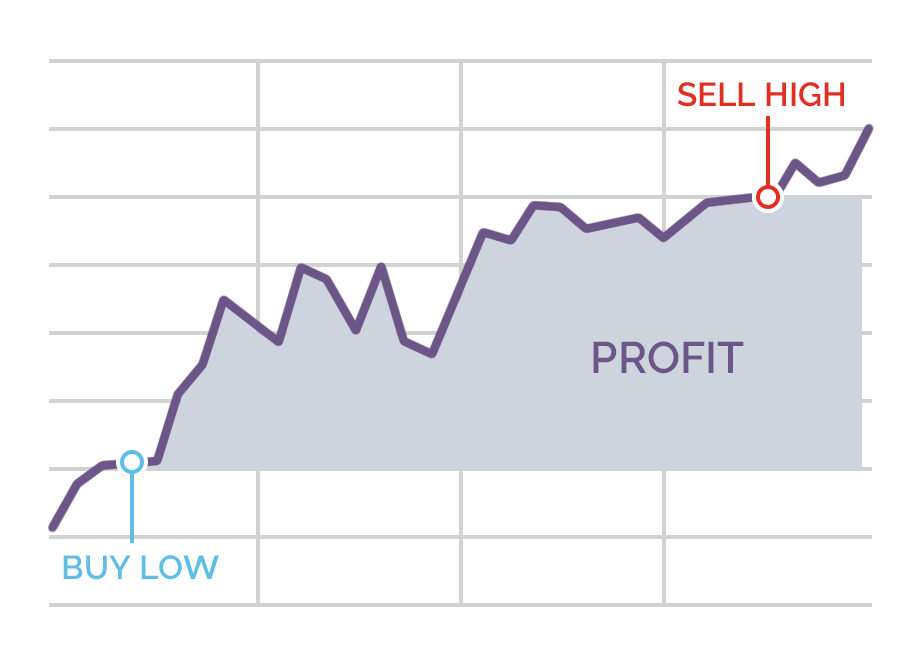

If the price of the security that you’re making a spread bet on moves in your favour beyond the spread price at which you entered the market, then your bet will be profitable.

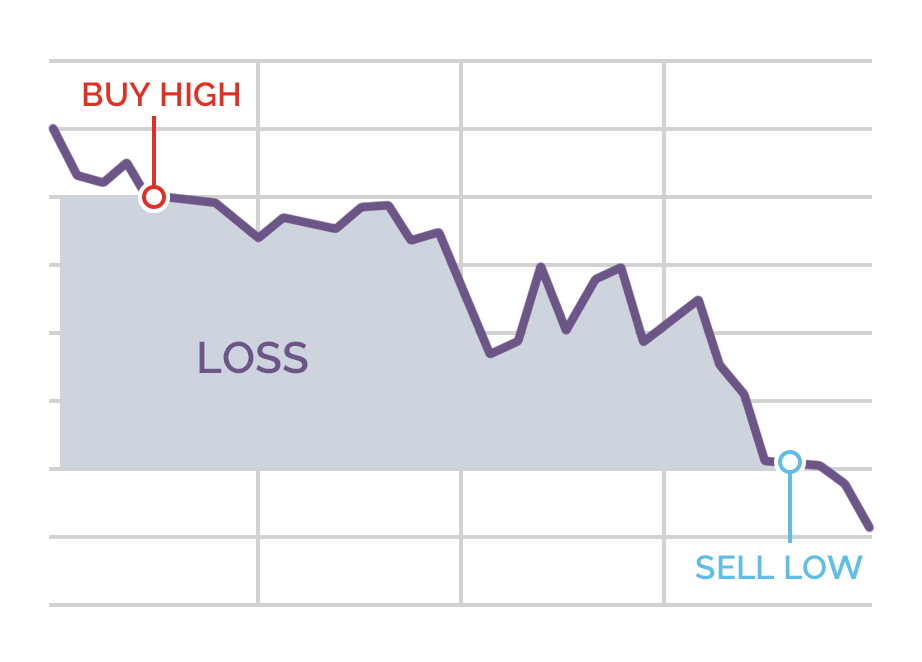

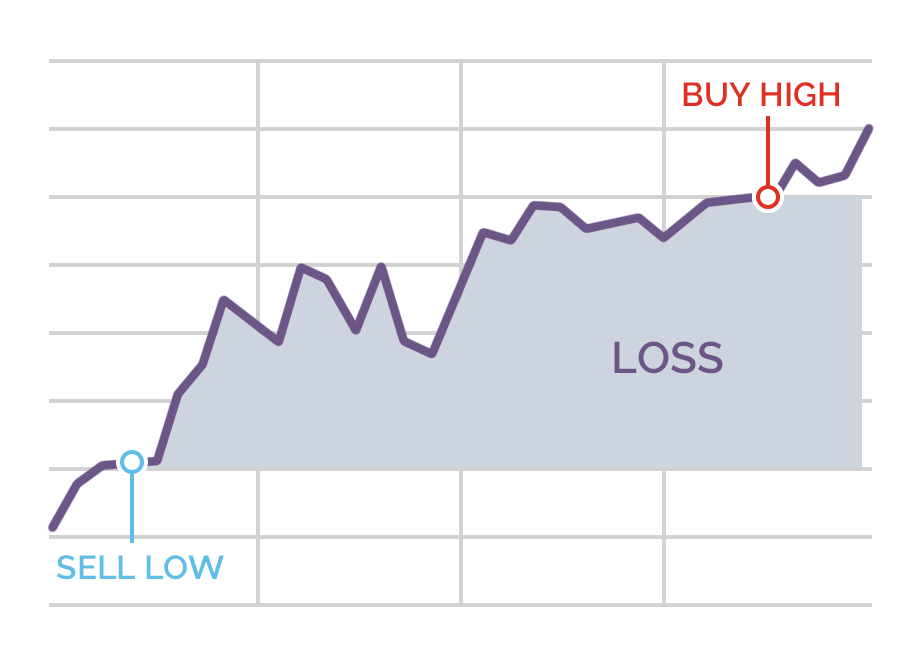

But if the market price moves in the opposite direction, against your bet, it will result in a loss.

You can control your level of risk in a spread bet with a stop-loss order which will close out your spread bet trade if the market moves a specified distance against you. You can exit your trade, locking in a profit if the price goes in your favour with a limit order.

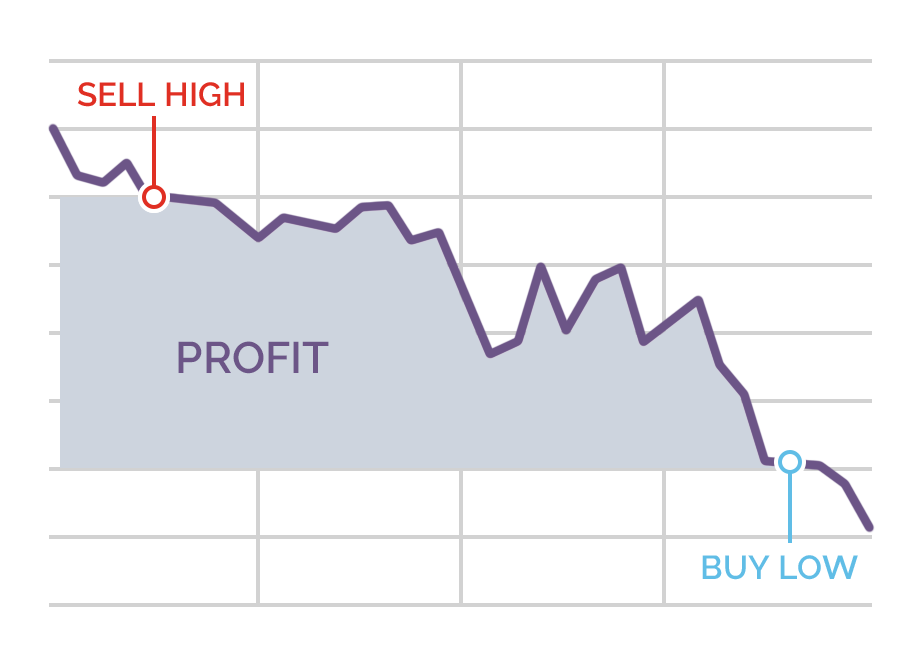

Since one of the advantages of spread betting is that you can just as easily sell short – anticipating a decline in price – as you can buy long – looking for price to rise, we’ll look at examples of both a long/buy spread bet trade and a short/sell spread bet trade.

Read:

Margin and stake

There are two considerations you have to take into account with each spread bet you make. First, there is the margin requirement. Spread betting is a leveraged investment, which means you do not have to put up the entire value of the underlying security that you’re betting on in order to place a trade.

Rather, you only need enough trading capital to put down a margin deposit to place a spread bet, which may be as little as a few percent of the total value of the underlying security.

You also have to decide the amount you want to stake on your spread bet. The amount of your stake will determine how much of the underlying asset you are trading and therefore how much margin is required for your spread bet. Your profit or loss in points on a spread bet trade will be multiplied by your stake amount.

- Learn more, take our premium course: Trading for Beginners

For example, if you wanted to place a spread bet on the FTSE 100 index (called the UK 100 in spread betting) for £1 a point, and the price was 6300, you could place a spread bet with a margin deposit of £315 (5%). That means you are getting £6,300 of total exposure to the underlying asset for a deposit of £315.

Notional value of the asset x the required margin percentage

Keep in mind that you must have enough trading capital in your account to cover the required margin, and also to be able to withstand the market even temporarily moving against your position.

A spread bet example – buy trade

Let’s look at an example of how a buy rolling daily spread bet on the share price of UK telecoms company Vodafone would work.

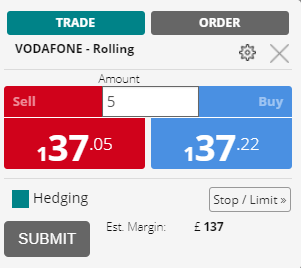

You’ve done your research and decide the price is going to go up. You log in to your broker’s platform, find the market and open up a deal ticket. The price quoted is 137.05 – 137.22.

You’ve done your research and decide the price is going to go up. You log in to your broker’s platform, find the market and open up a deal ticket. The price quoted is 137.05 – 137.22.

If you went ahead and placed the trade, then you would buy at the asking price of 137.22. In order for your spread bet to be profitable, the bid price – the lower price in the spread – must rise above 137.22.

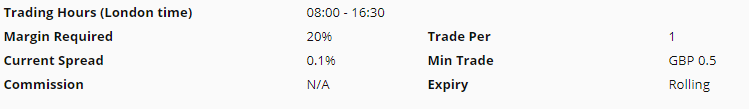

Company shares like Vodafone are quoted in pence when you spread bet (so a Vodafone share is actually trading at about £1.37 on the exchange) and you double-check the market information tab to remind yourself that the trade per is 1 unit.

You decide to stake £5 a point, this is the amount you will make or lose per 1 penny move in the price.

You can also see from the market information tab that the margin required is 20% of the notional value of the trade.

You can also confirm this on the trade ticket where is states estimated margin is £137. You will need to make sure you have sufficient cleared funds on deposit with the broker to place this trade.

You place the trade – buy £5 a point of Vodafone at 137.22. You normally get a confirmation through from the broker almost immediately confirming the trade has been placed.

The market barely moves that day and you haven’t closed the trade by the time the market closes at 16.30 UK time, so that means you’re going to incur an overnight funding charge at 10pm that evening. When you check back into your account the following morning you see a funding charge of 6 pence.

(2.5% + 0.5%)/365 x £686.10 = £0.06

By mid-morning the next day the price has risen, you’re in profit and you decide to exit the trade.

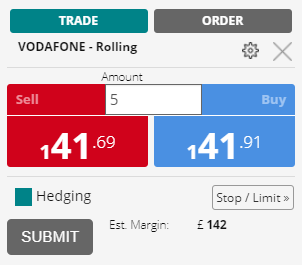

You open up a deal ticket and see the price quoted is 141.69 – 141.91. In order to exit your £5 a point long position, you need to sell back £5 a point at the sell/bid price of 141.69.

You place the trade – sell £5 a point of Vodafone at 141.69 – and like your opening order it is confirmed immediately – you’re flat and out of your Vodafone position, the broker will release your margin and any profit (or loss) on the trade will be available in your account.

141.69 – 137.22 = 4.47 points x £5 per point bet = £22.35 trading profit

Minus funding costs of £(0.06)

Total profit on the trade: £22.29

Conversely, if the price had fallen while you held the position you would be booking a loss calculated using the same method.

- Learn more, take our free course: Margin Trading Products

A spread bet example – selling short

If you believe the price of a security that you want to spread bet is going to fall, then you would want to place a spread bet selling short in order to profit from a decline in price.

For our short sell example, let’s consider a spread bet on a currency pair. GBP/USD, also known as cable, is the exchange between the British pound and the US dollar.

- You are quoted 1.23000 – 1.23008. This means £1 is worth about $1.23 in the underlying spot forex market.

- The bet per is 0.0001, this means a change from 1.23000 to 1.23010 is a one point move.

- You decide you want to sell £5 per point. This means the notional value of the trade would be £61,500. 12,300 points x £5.

- The margin required is 3.33% (30:1 leverage), so £2,048 is needed as a deposit for the trade.

You go short £5 a point GBP/USD at 1.23000, these are the scenarios if the trade moves 50 points in your favour (down) or 50 points against you (up).

Let’s say you set a limit order to buy if the price fell to 1.22500 and the spread your broker was quoting ticked down to 1.22492-1.22500 it would get filled, locking in a £250 profit on the trade.

If you’re selling short with your spread bet, you do not want the price of the underlying security to rise. If the spread quoted on GBP/USD had risen to 1.23492-1.23500, then you would be showing a loss of fifty points times your £5 stake amount – £250. You could, however, have limited your loss to, say, £100 by placing a stop-loss order at 1.23200 when you opened the trade. If you had done so, then as soon as the spread advanced to 1.23192-1.23200, your trade would automatically have been closed out.

If you hold a currency daily rolling spread bet overnight you pay the charge to roll it, you will also be charged something called the tom-next rate – this is paying the interest charge of the long currency netted of against receiving the interest rate of the currency you are short multiplied by your notional position.

Read:

Summary

There are three primary facts to keep in mind when spread betting:

1. The margin requirement for your spread bet depends on –

- The price of the underlying security

- The amount of your stake

- The margin percentage required for that specific security

2. In order for your spread bet to be profitable, the price must move enough to overcome the spread. You buy at the higher spread price, the ask price, but sell at the lower spread price, the bid price.

3. The amount of your profit or loss on your spread bet will be your stake amount times how many points the price has moved in your favour or against your position.

Start learning now

Learn the skills needed to trade the markets on our Trading for Beginners course.