Chapter 7

Spot Forex, CFD or Spread Bet?

The Foreign Exchange markets are the most traded global markets in the world, attracting more and more retail customers, who hope to take advantage of changes in currency pair prices.

Forex traders access the markets through financial products. Spot Forex, CFDs, and Spread Bets are the three main products traders use to access markets with. For example, a trader can trade the EUR/USD market with a CFD product.

The three products are similar as they all offer similar levels of margin and can be used to access nearly all currencies pairs, but they have a few differences that we will explain below.

- Learn more, take our free course: Margin Trading Products

Spot Forex

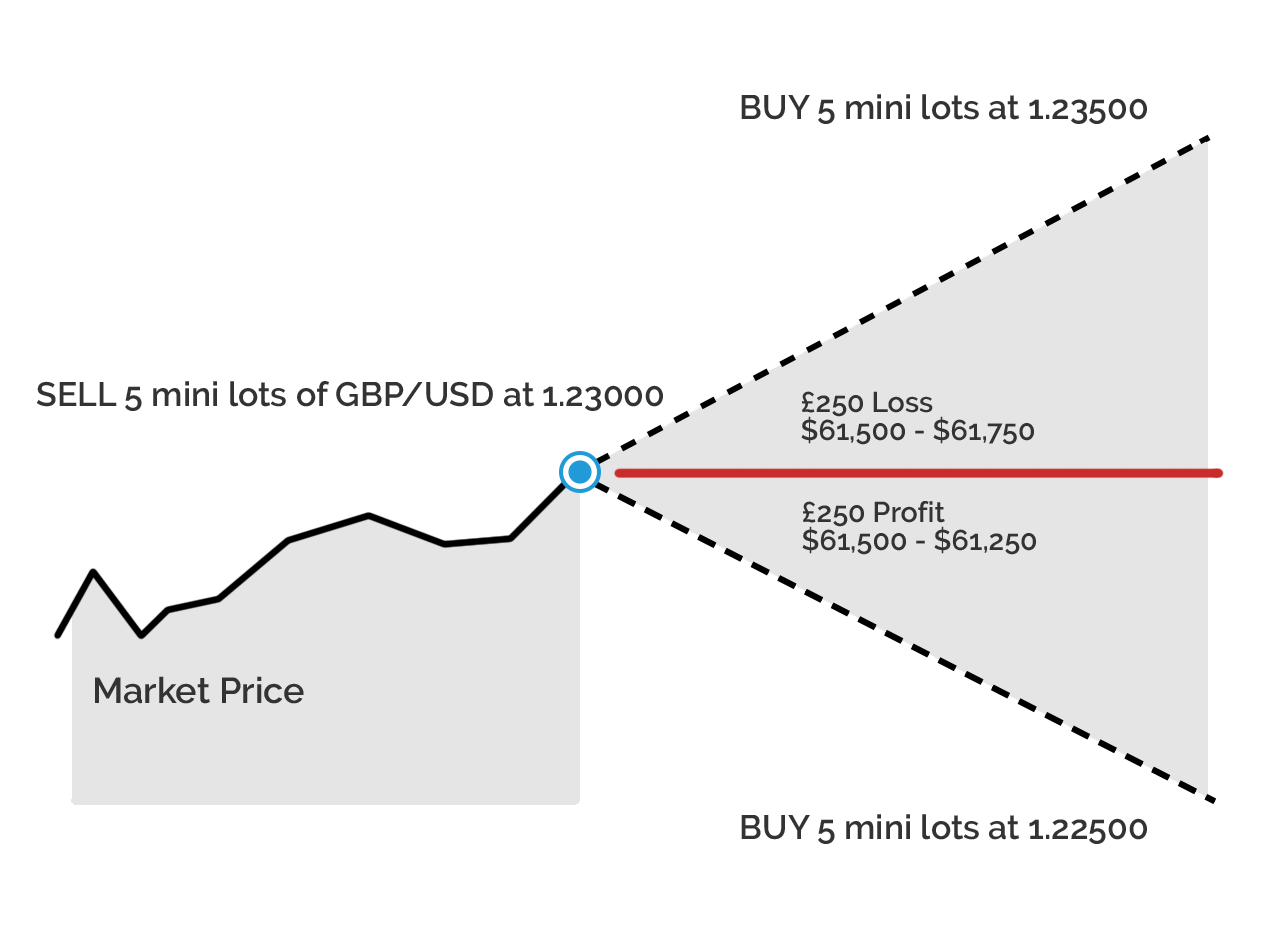

If the price moves 50 pips down to 1.22500 then the dollar has appreciated against sterling. The trader can buy back the £50,000 using just $61,250, leaving a $250 profit.

Alternatively, if the market price moved against them and dollar depreciated by 50 pips to 1.23500 when they came to buying back the £50,000 it would then cost $61,750, a loss of $250.

The distinguishing feature of trading spot Forex, compared to the other two product types we’re about to introduce you to, is it is not a derivative. The trader is trading the underlying asset – the two currencies need to settle 2 days after the transaction (the broker will do this for you). What this means is there does not need to be two legs of the trade (we did in our GBP/USD example). For instance, our trader going short £50,000 can cover this by buying £50,000 using another, better priced, currency pair.

The other reason to trade using spot Forex, and not the other products, is one of scale. Big volume traders, we’re talking hedge funds here and not private traders, like to transact in the underlying market. That way they know the price they got was ‘on market’ and not impacted by the size of trade relative to the provider of the derivative product. Retail derivative brokers are set up to cater for flow business (lots of small trades) and not large lumpy transactions.

Spot Forex pros:

- Permitted in a lot more countries than CFDs or spread bets.

- Traders are dealing in the underlying cash market so there can’t even be the risk of slippage in price between the underlying and the derivative markets (CFDs, spread bets).

- Very liquid markets traded nearly 24 hours a day.

- A much wider range of brokers offer spot Forex.

- Losses are likely to be tax-deductible.

Spot Forex cons:

- Traders can only trade currency markets through spot Forex.

- Profits are likely to be taxable.

Contracts for difference

Contracts for Difference (CFDs) represent a financial contract between a trader and their broker to exchange the difference between the opening price and the closing price of an asset. No underlying assets, in our case currencies, are exchanged. It is simply an agreement to exchange the difference in price.

The real benefit traders get from trading CFDs is they can trade the price of pretty much anything with a verifiable price – shares, indices, commodities, profit and definitely the currency markets – all from one trading account.

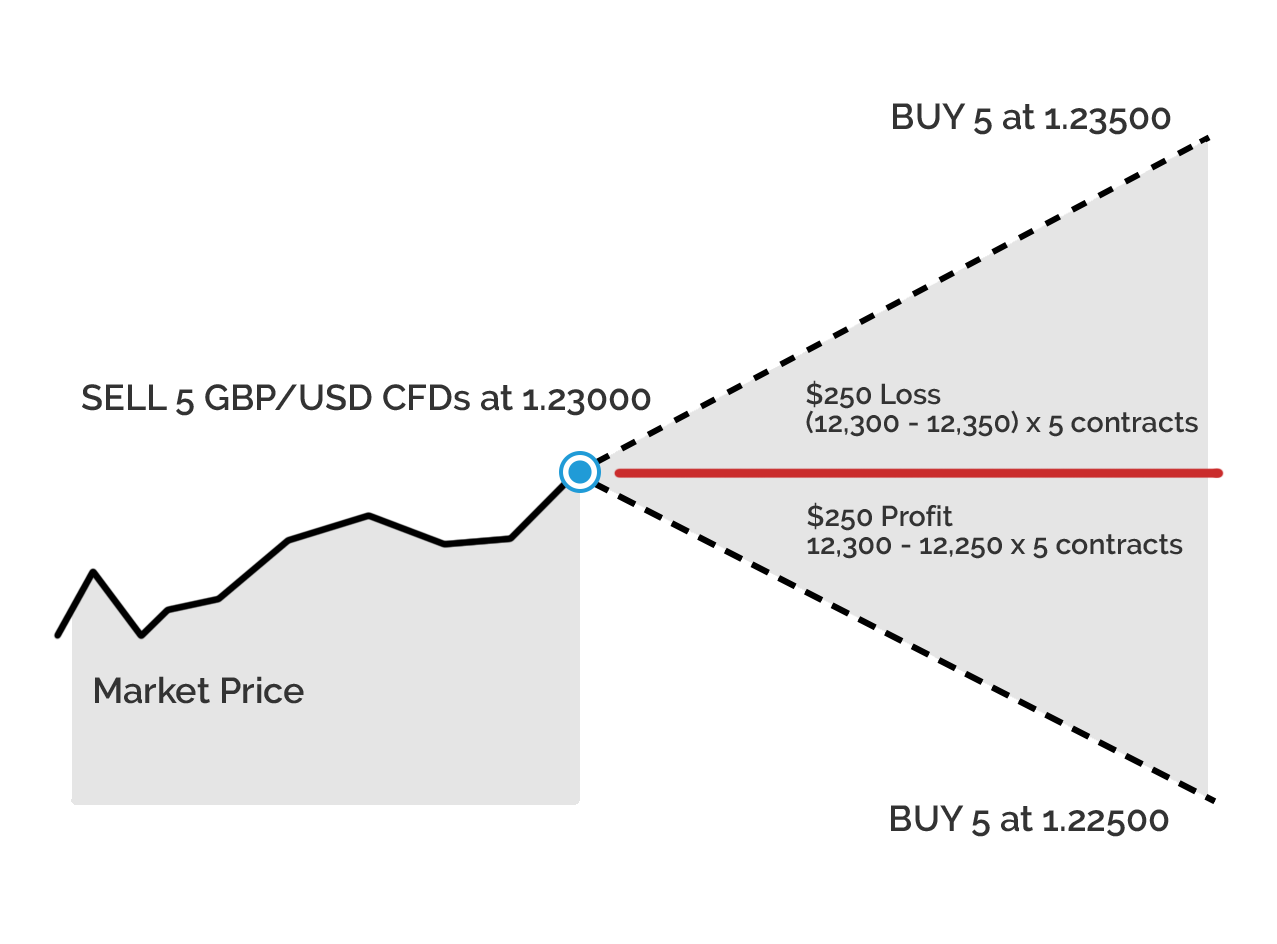

It is really important to check the size of the CFD contract the first time you trade with a broker – in this example, it is for 10,000 of the base currency (some broker’s CFDs are 100,000).

1 FX CFD contract is per 0.0001, so in our example below 1 contract gets you $12,300 of exposure.

By opening the trade and going short GBP/USD the trader is speculating USD will appreciate against GBP (or GBP depreciates against USD, its the same thing). To close the trade the trader must buy back the 5 CFD contracts.

The trader has to put up a similar amount of margin. Because no underlying currencies are exchanged they must buy back the 5 contracts to close the trade.

CFD pros:

- No stamp duty on share CFDs.

- A huge range of markets can be traded using them, the popular CFDs are for equities, fx, commodities and debt markets.

- Low transaction costs – much cheaper than buying or short selling (borrowing, selling and buying back later) an underlying asset.

- Traders do not have to take delivery of the physical asset – like barrels of oil.

- A CFD is traded over the counter – this means it is not traded via a central exchange, it is an agreement between two parties. This allows brokers to be innovative and flexible in the markets they offer traders. Cryptocurrency CFDs are the most recent example of this flexibility.

- Losses are likely to be tax-deductible (your tax status is unique to you, we are not tax advisors so please get some advice if you need it).

CFD cons:

- CFDs can exposure the trader to currency risk, even when they aren’t trading currencies.

- Leverage is hard-wired into the product. New traders sometimes don’t appreciate the underlying exposure they are taking on.

- Traders do not own the underlying asset and therefore don’t have any of the direct ownership rights you’d normally expect – like voting rights on company shares.

- Profits are likely to be taxable (your tax status is unique to you, we are not tax advisors so please get some advice if you need it).

- Banned or limited in some countries because of concerns over leverage, among other things.

Spread betting on currencies

In broad terms, a financial spread bet is a CFD wrapped up as a bet for tax reasons. With financial spread betting in the UK and Ireland, any profits are normally tax-free.

Like with CFDs, a spread bet is an OTC derivative and the trader does not own the underlying asset. In order to trade, the broker needs the trader to place margin on the account, not requiring the trader to fully fund the value of the underlying asset being bet on creates leverage.

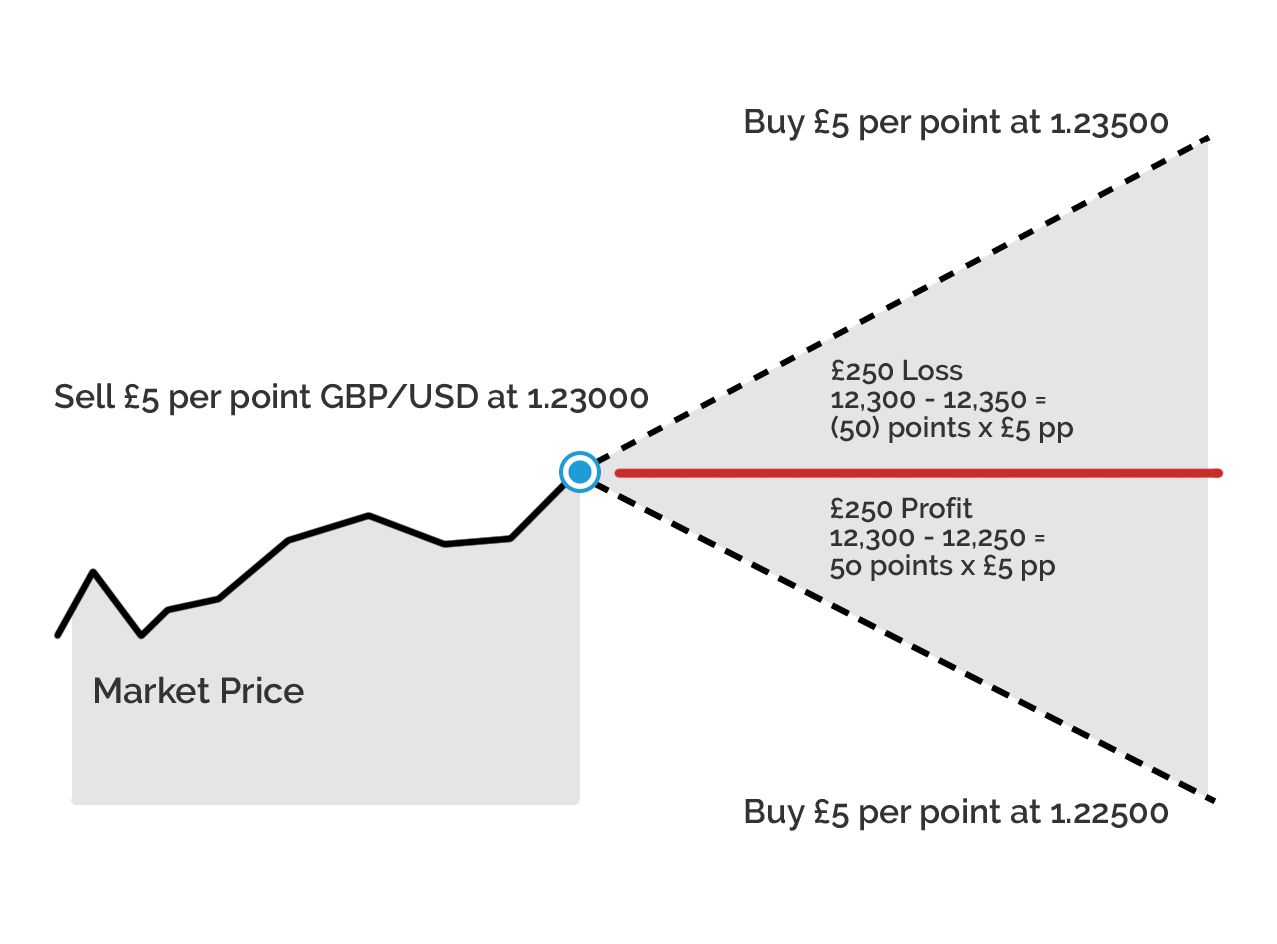

Note the base currency is £, so the betting per point is in £ and therefore so is the P&L. The exposure to USD at the start of this example was £12,300, please note the difference to the CFD, where it was $12.300.

Spread betting pros:

- No stamp duty on company share spread bets.

- No capital gains tax in the UK and Ireland on profits.

- Unlike CFDs, there is no base currency risk.

- A huge range of markets can be traded using them.

- Low transaction costs, like CFDs.

- OTC – so flexible and innovative.

Spread betting cons:

- Losses are likely to not be tax deductible so FSBs are not that useful when hedging.

- Leverage is hard-wired into the product. New traders sometimes don’t appreciate the underlying exposure they are taking on.

- Traders do not own the underlying asset and therefore don’t have any of the direct ownership rights you’d normally expect – like voting rights on company shares.

- Banned or limited in some countries because it’s legally a CFD. Its also banned or limited in other countries because it’s a bet.

- Learn more, take our free course: Margin Trading Products

Which product to use?

By now you should appreciate how similar these products are: similar range of currency pairs available, similar leverage and a similar exposure to the underlying price movements. So, how do retail traders choose?

Consequently, traders have to turn to spot Forex trading if they want to exchange currencies. Here is a full breakdown of the legality of CFDs around the world.

A major factor that could influence your choice of product are the taxes applied to each financial instrument.

Spot Forex trading has similar rules to the taxes applied with CFD trading, meaning that you’ll typically pay Capital Gains Tax on profits, and your losses are deductible.

On the other hand, spread betting activities are normally tax-free in the U.K. and Ireland, as you do not have to pay capital gains tax. Moreover, spot Forex trading, CFDs, and spread bets do not incur any stamp duty.

With CFDs, the P&L is denominated in the contract’s currency, while with spread bets, you bet in the base currency of your account, meaning that your main concern is whether or not the currency pair will finish higher than the opening price.

A final thought on products…

Everyone’s circumstances are different so what might work for you won’t for someone else. The important thing is to know what products are available so you can make an informed decision. Don’t just go for the first product or broker you come across, get clear on the type of product you want to use to trade the currency markets with and find the best broker for it.

Start learning now

Learn the skills needed to trade the markets on our Trading for Beginners course.