Trading Basics

Backwardation

Backwardation occurs when a bid price exceeds the ask price. This usually occurs when stock is suspended or under a share repurchase scheme.

It can also mean that a futures contract will trade at a higher price when it is coming close to expiring. The opposite of backwardation is known as contango.

Full Overview:

Backwardation and contango are common pricing situations in the futures market.

They occur when the spot price of a commodity or financial instrument differs from the forward price of a futures contract – arguably a fairly normal situation.

Since backwardation and contango can be regularly spotted in the futures and spot markets, traders can employ certain techniques to take advantage of this price discrepancy, and we’ll show you how in the following lines.

Normal Backwardation

Let’s start with normal backwardation.

Backwardation occurs when the current futures price trades below the current spot price of the underlying financial instrument.

As the futures contract approaches expiration, its price will rise and converge with the higher spot price as compared to when the contract’s expiration was further away.

The convergence of futures contracts that approach maturity and the spot prices of the underlying instruments is a normal pricing situation and favours those traders who are net long in the futures market.

Contango Backwardation

Contango is basically the opposite situation of normal backwardation.

It occurs when the current futures price of a commodity or other financial instrument trades above the current spot price of the underlying instrument, which indicates that the futures price shall eventually fall to converge with the spot price.

Similar to backwardation, a futures contract that is in contango will gradually approach the spot price over time as the contract approaches its expiration date.

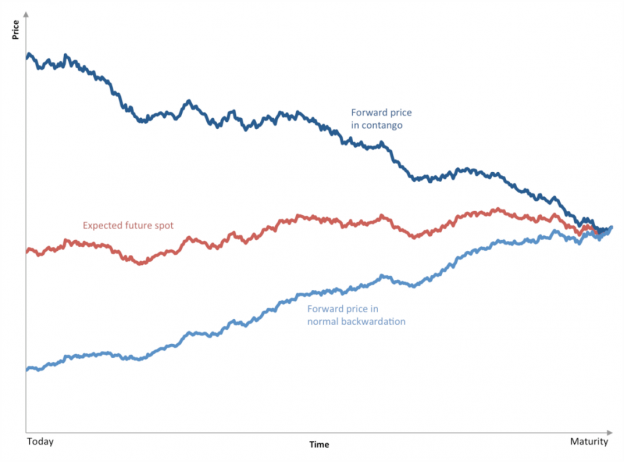

The following chart shows how a contango and backwardation curve looks like as the futures contract approaches its maturity.

A futures price that is in contango will fall over time, while a futures price that is in backwardation will rise over time, given the expected spot price remains more or less stable, i.e. above the futures price in backwardation, and below the futures price in contango.

As can be seen on the chart, prices in contango are down sloping, while the opposite is true for prices in backwardation.

This can be easily observed by following forward curves of any financial instrument.

Why Does Backwardation Happen?

The primary reason why a backwardation pricing situation happens is a shortage of the underlying asset in the spot market.

This is especially true for commodities.

To make this concept clearer, let’s take a look at the following oil backwardation example.

Backwardation Examples

While there are many factors causing backwardation and contango pricing situations, let’s say that a certain market condition, such as an unexpected supply outage or an OPEC decision to cut production, causes the price of Brent crude to rise in the spot market.

If market participants believe that this situation is a one-off and that supply will eventually return to normal levels in the coming period, futures contracts that are far away from expiration may remain stable and trade at a lower price than the current market price.

Since the futures price and the spot price need to converge eventually, traders can buy that futures contract and take advantage of the current pricing situation.

This is an example of backwardation.

Both the futures prices and spot prices move on a regular basis, but they eventually meet at the expiration date of the futures contract.

If this would not be the case, speculators and short-term traders could make a riskless profit by buying futures contracts that are very close to their expiration date, take the physical delivery of the underlying commodity on the expiration date and sell the commodity at the higher spot price.

This arbitrage opportunity is eventually a major reason why futures prices converge with spot prices over time.

Read: What is arbitrage?

Here's How to Profit From Backwardation

Since futures prices tend to rise over time and converge with the higher spot prices, backwardation favours those traders and investors who are net long.

This is the first condition to profit from backwardation.

The other condition would be that the spot price remains above the futures price on the contract’s expiration date.

Let’s say gold traders expect the price of gold to rise from current levels of $1,200 to $1,500 by mid next year.

In order to profit from backwardation, traders would need to buy a futures contract on gold that trades below the expected spot price and make a profit as the futures price converges with the spot price over time.

While futures backwardation and contango can occur in any asset class, they’re most common in commodities such as gold, silver and crude oil.

In addition, traders can also use VIX futures, which measure the future implied volatility of the S&P 500 index, to take advantage of VIX backwardation pricing situations.

- Take our free course: Technical Analysis Explained

- Take our free course: Trends, Support & Resistance

- Take our free course: Japanese Candlesticks Decoded

- Take our free course: Reversal Price Patterns

- Take our free course: Continuation Price Patterns

- Take our premium course: Trading for Beginners

Other Trading Basics

Counterparty

You need at least two parties in a financial transaction, they are counterparties.

Start learning now

Learn the skills needed to trade the markets on our Trading for Beginners course.