Trading Basics

BoE Rate Decision

Brief Summary

The Bank of England’s interest rate decision is announced following the meeting of its monetary policy committee, which meets eight times a year.

The announcement is made on the Thursday following the meeting at noon GMT. If the MPC is hawkish about the inflationary outlook of the economy and raises interest rates it is normally positive, or bullish, for Sterling. Likewise, if the MPC has a dovish view on the UK economy and cuts the interest rate it is seen as negative, or bearish.

Full Overview

The Bank of England’s Monetary Policy Committee meets eight times a year to discuss adjustments to the current monetary policy of the United Kingdom. The decisions made on those meetings can have a substantial and prolonged impact on financial markets, especially on the value of the British pound.

In this article, we’ll shed some light on why the Bank of England rate decision is so important to follow and what impact it can have on the markets.

What is the Bank of England?

The Bank of England acts as the central bank for the United Kingdom, controlling monetary policy in order to ensure price stability and economic growth. The Bank of England plays an important role in the overall economic health of the United Kingdom and has a wide range of responsibilities. The Bank issues banknotes and coins, acts as a lender of last resort for commercial banks and makes regular adjustments to monetary policy and interest rates to achieve its mandate.

Along with the Swedish Riksbank, the Bank of England is one of the oldest central banks in the world. Established in 1694, the bank has been responsible for the UK’s interest rate since 1997. Although the bank was initially established as a private institution to help the government raise money through the issuance of bonds, the Bank Charter Act of 1844 gave the BoE monopoly on the issuance of currency in England and Wales. However, it wasn’t until 1997 that the bank became completely politically independent and responsible for the monetary policy of the UK.

How Does BoE Make Rate Decisions?

The Bank of England’s monetary policy and interest rate decisions have the main goal to keep prices stable. The Bank aims to achieve the Government’s inflation target of 2%. However, it’s not only inflation that the BoE is targeting, but also other economic aims for growth and employment. Sometimes, the BoE has to balance between keeping inflation low and supporting economic growth and low unemployment, which is not always an easy task.

So, how does the Bank of England make monetary policy decisions?

Each year, the Chancellor who leads the Government’s Treasury sends a remit letter to the Governor of the Bank of England. In the letter, the Chancellor sets out a framework that is followed by the central bank.

The Monetary Policy Committee, which meets roughly once every six weeks, holds several meetings at which the committee members assess the current economic situation before deciding what action to take. After a decision is made on whether monetary policy should be changed or not, it can take up to two years until the effect of the decisions become visible in the economy. The MPC also explains the reasons for their decisions in a detailed quarterly Monetary Policy Report.

A typical headline of the MPC announcement looks like this:

How Do MPC Meetings Work?

There’s a total of four meetings before the MPC decides on the current monetary policy and makes a public announcement.

- Pre-MPC meeting: At the pre-MPC meeting, members of the MPC are briefed on the latest developments in the economy, including inflationary pressures, economic growth, and labour market statistics.

- First meeting: At the first meeting, which is usually held one week before the final announcement, members of the MPC meet and discuss the latest economic data.

- Second meeting: At the second meeting, MPC members discuss what changes to the current monetary policy would be appropriate in light of the current economic conditions. The second meeting is usually held on the Monday before the final announcement.

- Final meeting: The final meeting is held on Wednesday before the final announcement. At this meeting, the Governor recommends what actions should be taken and the members of the MPC vote. While there’s no need to reach a consensus of opinion, the Governor has the final word in case there is a tie.

- MPC announcement: Finally, the MPC’s decisions together with the minutes of the meeting are announced the following day, on Thursday, at noon.

Monetary Policy Decisions

Interest rate decisions are made by the Bank of England’s Monetary Policy Committee, which consists of nine members: The governor, three deputy governors, a chief economist, and the four remaining members being appointed by the Chancellor of the Exchequer.

The Bank’s Monetary Policy Committee meets eight times a year to discuss changes to the current interest rate. In their decision, the MPC takes into account the current inflation rate, future inflationary expectations, and other economic variables in order to set the appropriate interest rate to achieve its inflation target.

Each member of the MPC has one vote, and the number of votes determines whether interest rates will be changed or not. There’s no need to reach a consensus of opinion.

At the meeting, the Monetary Policy Committee decides whether to hike or cut the bank rate, which is the base rate charged to domestic commercial banks for loans taken from the Bank of England.

At the end of each day, commercial banks need to meet the minimum reserve requirement by having a certain amount of cash on hand. If a commercial bank’s reserve falls below the minimum requirements, it has the option to borrow funds from other commercial banks at the overnight rate or turn to the Bank of England which acts as the lender of last resort.

The BoE’s bank rate impacts all other interest rates in the country, which makes it so important to follow the bank’s interest rate decisions. It’s usually lowered to support the economy during a downturn and increased to prevent the economy from overheating and ease inflationary pressures.

A lower bank rate means it costs you less to borrow money, but you’ll also earn less on your savings account.

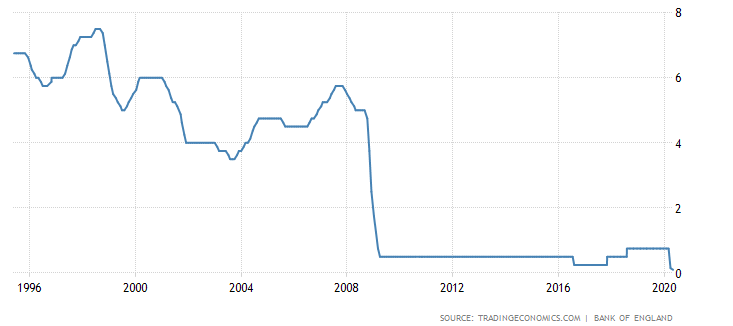

The following chart shows the history of the Bank of England interest rate decisions since 1996.

Why Do Traders Care?

The Bank of England interest rate decision can have a significant impact on financial markets, including the value of the British pound and bond markets. That’s why investors and traders around the world closely follow each MPC meeting and announcement.

Often, markets already have an expectation of where interest rates will go ahead of the announcement. This “whisper number” is often derived from the previous announcements of the Bank of England, as the Bank tries to provide forward guidance to market participants of the direction of the interest rate.

The most volatile market conditions emerge when the actual interest rate decision doesn’t match market forecasts. If the Bank of England unexpectedly hikes rates, this will have a significant impact on the British pound. Under these circumstances, it’s not unusual for the pound to move hundreds of pips against the US dollar in a matter of minutes.

On the contrary, if the BoE unexpectedly cuts rates, the pound will most likely respond with a dramatic fall in value in a short period of time.

This difference between the actual announcement and market forecasts led to a surge in value of the British pound. The following chart shows the 4-hour timeframe of the British pound vs US dollar pair (July 14 in the shaded area.) The pound rose more than 300 pips (more than 2.5%) against the greenback on that day.

Here’s another example of the BoE announcement catching the market off guard. On January 30, the MPC decided to leave interest rates unchanged at 0.75%, meeting market expectations. Although some might argue that this shouldn’t have a substantial impact on the value of the British pound, let’s take a look at the details of the report.

Together with the interest rate announcement, the BoE reports the official bank rate votes, which are the votes of the MPC members. Market expectations were set for a vote of 0-3-6, which means that zero members vote for a rate increase, three members vote for a rate decrease, and six members of the MPC vote for the rate to remain at the current level.

The actual votes came in like this: 0-2-7. This means that zero members voted for a rate increase, but only two members voted for a rate decrease in contrast to market forecasts of three members voting for cutting rates.

This sent a signal that the MPC was more hawkish than markets expected and led to a rise in the value of the British pound. The reaction of the currency against the US dollar during that day can be seen in the following chart.

Final Words

The Bank of England is the central bank for the United Kingdom, responsible for the country’s monetary policy, official bank rate, and money supply. Established in the 17th century, the BoE is one of the oldest central banks in the world, along with the Swedish Riksbank.

The Bank’s policy-setting body is the Monetary Policy Committee which meets 8 times a year, roughly every 6 weeks. At their meetings, the MPC assesses the current economic conditions in the country and decides on changes to the monetary policy.

Given its importance and impact on financial markets, traders and other market participants should closely follow each MPC announcement. Unexpected rate hikes or cuts can send shockwaves in the markets and create attractive trading opportunities for the savvy trader.

Other Trading Basics

Balance

A summarised financial result of all funds deposited in, and withdrawn from the customer’s account, and of all closed positions in that account.

Commercial Paper

How big companies finance short-term cash flow.

Like bonds but without the coupon, instead, the APR is determined by the discount the agreements are entered into and the length of time to repayment.

For example, a blue chip company might borrow $9.95m dollars today and repay $10m in a month’s time.

Start learning now

Learn the skills needed to trade the markets on our Trading for Beginners course.