Chapter 17

Developing Winning Forex Strategies

You should now have a pretty good handle on how Forex works so let’s turn our focus to how you might go about developing a winning strategy.

These are the broad steps to follow to develop a winning Forex strategy that you can stick to.

- Determine which kind of trader you are.

- Choose which trading style suits you best.

- Define your method of entering/exiting the market.

- Define your risk.

- Back and forward-test your system.

- Learn more, take our premium course: Trading for Beginners

Step 1: Which kind of trader are you?

Why is it so important to figure out your trader personality profile? The power of knowing which kind of trader you are will allow you to focus your time, energy and attention on developing Forex trading strategies that work with your trading style.

Sometimes the best way to make money for one type of trader can be a poor fit and a losing strategy for another type.

Learning how trading Forex works and how to make it profitable is hard enough, so working on strategies with the highest probability of working out for you will simplify the whole process and give yourself a better chance to succeed.

- Why do you want to start trading in the first place?

- What do you hope to achieve?

- What is your general knowledge of the markets and their correlations, trading, money management, trading psychology, trading platforms, Forex brokers and financial products?

- How much education will you need before starting trading?

- How often will you be able to trade?

- Will your dedicated trading time be fixed, or do you have to be flexible?

- What will your risk level be?

- How well can you control your emotions and your stress?

- Do you prefer to see the results of your trades within the same day, or can you wait a few days for your trades to play out?

- How often would you prefer to check your trades?

- Will you use technical or fundamental analysis to determine your edge and ultimately your entry/exit setups?

- What amount of money can you allocate to Forex trading?

Step 2: Which trading style suits you best?

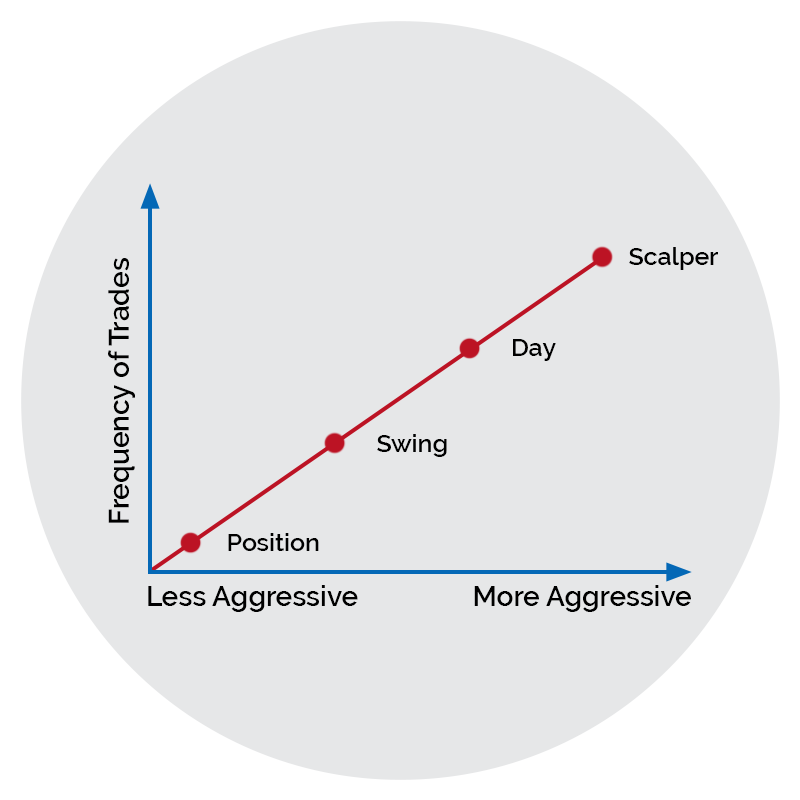

Once you’ve answered all these questions, you will start to see where you fit within the trading spectrum. There are a few different types and categories within which you’ll fit:

- A trading timeframe preference: scalper, day trader, swing trader, position trader

- A type of trading analysis preference: technical trader, fundamental trader

- A risk tolerance preference: risk-averse, risk-neutral, risk-loving

You will be one of four types of trader: Scalper, Day, Swing or Position.

Scalping and day trading

These two kinds of trading are the most active and aggressive type of currency trading, as they both imply that all your trading positions will be opened and closed within the same trading day.

These trading styles work with very short-term trading strategies to make tiny but consistent profits and increase returns through high leverage.

Both strategies can be stressful and require being able to stay extremely focused and available in front of your trading desk while you’re trading.

Read: 7 Must Know FX Day Trading Styles and Techniques

Scalping and day trading is for you if you:

- Don’t like to hold your positions overnight, and prefer intra-day trading.

- Like to know if you earned or lost money at the end of your trading day.

- Tolerate a high level of market and leverage risk.

- Are available to be in front of the market and quickly react to potential opportunities.

- Can deal with a relatively high level of stress.

- Like fast-paced trading.

Swing trading

This trading style is a medium-term approach based on taking advantage of changes in the momentum of a currency pair within the primary trend. Traders typically hold positions from a few days to a few weeks.

Swing trading requires a lot of patience, as you’ll be holding your trading positions – normally with a fair degree of leverage – for several days or weeks. It’s ideal for engaged part-time traders, as they don’t always have the time to analyse the market every day.

Swing trading is for you if:

- You don’t have much time to spend in front of the screens every day.

- You can hold onto your positions for days/weeks.

- You favour technical analysis.

Position trading

This trading style is a long-term approach based on taking advantage of changes in the long term price of a currency pair. Traders typically hold positions for a few weeks, months and even years.

Traders take a position and hold it, they are not bothered about short term fluctuations in price.

Typically these positions are either taken in the currency futures market – where funding is priced in – and with a prudent amount of leverage. Position traders might only do their analysis every month or so and are seeking to identify and trade big trends.

Position trading is for you if:

- You don’t have much time to spend in front of the screens every week.

- You can hold onto your positions for months or years.

- You don’t want to use much leverage.

- You favour fundamental analysis.

When figuring out which trading style best suits your personality, you need to take into consideration all of the following elements: your current schedule, your attention span, and your risk aversion.

Consequently, you need to match your selected timeframe with your lifestyle and personality.

With position trading, you might trade using a daily timeframe. With swing trading, you may stay in position from a couple of days to a few weeks, while using 4-hour to daily charts. With scalping and day trading you will stay in a position anywhere from a few seconds to a day, using anything from tick to hourly charts.

Step 3: Which kind of analysis method will you use to make your trading decisions?

There are a few types of analysis that could be a good fit for your personality. You could be a noise trader, a sentiment trader, an arbitrage trader, and a market timer, but the most common ones are technical traders and fundamental traders.

They use trend analysis, support and resistance analysis as well as mathematical and technical indicators, Japanese candlestick analysis, market theory and price pattern analysis to trade.

A fundamental Forex trader will predominantly use news trading or currency carry trading strategies, mostly based on interest rates changes that have the highest impact on the evolution of exchange rates.

Step 4: Which method will you follow to enter/exit the market?

We think both analysis methods should be used.

On the Forex markets, traders usually rely on technical analysis to time their entry and exit from the market, while still keeping an eye on the economic calendar to keep abreast of news that can affect market volatility and trigger potential trading opportunities.

Once you know which kind of market analysis to use with your trading style, you have to spot and understand the market phases. There are different tools and indicators that work best under certain market conditions.

- Take our free course: Technical Analysis Explained

- Take our free course: Trends, Support & Resistance

- Take our free course: Japanese Candlesticks Decoded

- Take our free course: Reversal Price Patterns

- Take our free course: Continuation Price Patterns

- Take our premium course: Trading for Beginners

Define which trading conditions are best for your trading style

Whether you’re using a short-term approach such as the Forex scalping, or a longer-term one like swing trading, you need to determine specific set-ups you want to be targeting to be profitable, these include:

- Hedging

- Forex arbitrage strategy

- Forex pullback trading strategy

- Breakouts

- Forex trend strategy

Once you know which trading conditions you prefer to trade – ranging markets, trending markets, volatile/non-volatile markets, pullback or breakout phases – you can specialise in the market phase and learn how to master the trading indicators and tools used to identify it.

Or, instead of having one single trading strategy, you could also develop several trading systems for each of the major market phases to better adapt your trading to market conditions, using specific technical indicators, drawing tools, and candlestick patterns.

- Learn more, take our free course: Simple Breakout Strategy

Define your risk while following sound risk and money management rules

Determining your risk is all about knowing how much money you’re willing to lose on each trading position. Thinking about losing isn’t easy, but is necessary to be a good trader.

Knowing the appropriate level of risk depends on each trader and their relationship to risk, as well as how well a trader knows themselves.

There are common money and risk management rules you can follow, such as:

- Only use the money you can afford to lose.

- Adapt your risk management to your trading style.

- Use the right position size.

- Always use stop-loss and limit orders.

- Set your risk/reward ratio to a minimum of 1:2 (1:3 if you’re a swing or position trader).

- Risk a maximum of 1% of your available trading capital per position.

- Avoid over-leveraging.

Leverage is a great tool to use to increase your potential profits, but it also increases your potential losses, so use the right amount of leverage for your trading capital and risk tolerance.

Step 5: Back and forward-test your system

Once you’ve determined which kind of Forex trader you are and what kind of trading style best suits your personality, you need to test your trading strategy with historical data (back-test) as well as with current market conditions and actual trading (forward-test).

This will help you be more confident that you’re using a system that makes money, as well as uncover what market conditions are most profitable.

It is also practical to objectively analyse the reliability of your trading strategy and make any necessary changes to improve its efficiency before using real money on a live trading account with it.

What is back-testing?

Back-testing is the testing of your trading strategy on a set of historical data, as if you were trading at that time using your selected strategy.

However, it’s important not to tweak your variables too much, as you would be creating a trading system that’s very specific to the specific market conditions that are inherent to the particular historical data that you used. As a result, your strategy would likely fail to adapt itself to future price movements. This phenomenon is also known as “curve fitting”.

What is forward-testing?

While back-testing focuses on a particular set of data with specific conditions in the past (or “in-sample” data), forward-testing broadens the data on which you test your strategy, using live data (or “out-of-sample” data).

One way to paper trade is to open a “demo” account – a trading account that mimics real-time market and trading conditions with virtual funds, so then you can determine if your strategy might be profitable.

Whether you’re a novice trader, or a more advanced one, paper trading is necessary in your trading journey. As a trader with no previous experience, paper trading is great for getting used to the markets and how trading works, as well as to progress without risking any real money.

If you have more experience, you may find it useful to paper trade to refine your trading system without putting money at risk.

Which data should you monitor?

In any case, the main goal of back-testing and paper trading is to test the proficiency and adeptness of your strategy and its capacity to maintain winning trades with positive gains.

For this, you need to have a certain amount of data about your trading.

- Date and time of the opening and closing of your positions to compute the length of your position

- The direction of your trade: long or short

- Opening and closing price to compute your P&L

- Kind of trading orders used: market, limit, stop, OCO

Comments about:

- Why you opened/closed your positions

- How you felt before/during/after a trade

- How stressful/confident you were

- What the easiest/hardest part was while trading

Using a demo account gives you access to a lot of data:

- Number of trades

- Average win

- Average loss

- Average risk to reward ratio

- Average trade time

- Probability of win – number of winning trades / total number of trades

- Probability of loss – number of losing trades / total number of trades

- Trading expectancy – (win rate*average win) – (lose rate*average loss) – the amount a trader can expect to make back from every dollar they risk over the long term.

- Profit factor – gross profit / gross loss – to know if and how a trading strategy is profitable and adapted to the trader’s risk tolerance.

- Equity curve – the visual representation of the cumulated P&L over a period of time, which illustrates whether the trading account is making money (ascending curve), or losing money (descending curve).

- Maximum drawdown (MDD) – the maximum loss from peak to valley of an investment portfolio – this is a volatility measure that helps to determine the right amount of risk for better capital preservation.

Trading expectancy and Profit factor are among the most important statistics to determine what needs to be changed in your strategy.

Trading expectancy

Trading expectancy is all about the average amount of money you can expect to win/lose per trade. Knowing how much your system can generate will definitely help you better manage your expectations and emotions.

Another important thing to understand is that you don’t need to target the highest win rate possible, because this isn’t necessarily indicative of a high performing strategy. The same applies to a low win rate – having a low win rate doesn’t necessarily mean that you’re losing money.

It all depends on how much you win when you do!

Everything has to be put into perspective in relation to expectancy.

With a trading account of $10,000, your expectancy is positive $100:

(0.4*$1,000) – (0.6*500) = $400 – $300 = $100

Your trading system makes money because you have a positive expectancy of $100, even though your strategy produces losing trades 60% of the time.

With a trading size of $10,000, the expectancy of your strategy is negative -$160:

(0.7*$500) – (0.3*$1,700) = $350 – $510 = -$160

This trading strategy loses money because of a negative expectancy of -$160, even though your system produces winning trades 70% of the time.

Profit factor

Profit factor is an easy measure of the quality of your trading system – it is the gross profit on your trades divides by the gross loss, this will tell you the amount of profit per unit of risk. This number can help you identify the strategy with the highest returns and the lowest level of risk possible.

Profit factor is an important tool when dealing with risk and money management.

How much testing do you need to do?

There is no right answer here, except to say the more the better. This is a feature of how much historic data you can get your hands on, how often your strategy triggers a trade to forward-test and how much time you have to spare to test.

The more testing you can do and get a positive expectancy on the more confident you can be you have a profitable strategy. The more confident you are in a strategy, generally, the more real money you should be prepared to risk on it.

A final point on demo environments

Moving from a demo account to a real account isn’t as easy as you might think, as there are some differences to be aware of that can affect your trading performance. These differences in trading performance are typically technical and behavioural.

Another psychological factor is the fact that a demo account will offer you more virtual funds than what you would normally use, which nudges you towards making riskier trades than what you would otherwise do in real-life.

In summary

When deciding how you should start Forex trading, remember to follow these 5 steps:

- Determine which kind of trader you are.

- Choose which trading style suits you best.

- Define your method of entering/exiting the market.

- Define your risk.

- Back and forward-test your system.

Whether you’re using a simple Forex strategy, or a more advanced Forex strategy, you need to master it before you start trading for real.

Start learning now

Learn the skills needed to trade the markets on our Trading for Beginners course.