Chapter 11

How Spread Bets are Priced

Understanding the spread – the basics

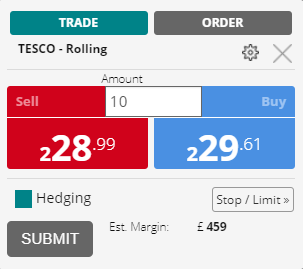

The spread is the difference between the bid price and the offer price quoted for any financial security. All spread betting companies quote a bid-offer spread for all the markets they offer.

Spread betting companies, the brokers, get these prices from their liquidity providers or exchanges, these are super-fast data feeds with very accurate prices – the broker can not afford to quote a price that is out of date by even a second or two.

The bid price is the lower price quoted in the spread – the price at which sell orders are filled. The offer price is the higher price quoted in the spread and the price at which buy orders are filled.

The spread in spread betting is basically the cost of trading because the spread is where spread betting firms make their money. There are no commission charges for spread betting. The “fee” for trading is instead built into the spreads quoted.

The spread betting firm makes most of its money by market making – this means having lots of traders coming together in a particular market, lots going long at the offer price, lots going short at the bid price. So long as this flow of business doesn’t become too lopsided the broker isn’t that fussed about whether its clients go long or short. By quoting a spread the broker knows on average it will make a bit of money each time anyone trades.

How the spread is calculated

The size of the spread offered on a spread bet is ultimately a commercial decision for the broker. Most spread betting firms just add a mark-up to the bid-ask spread of the underlying financial asset. The mark-up has been carefully calculated to provide the spread betting company with a net profit on all the spread bets made on a given asset.

- Learn more, take our free course: Breaking Down Trading Costs

Fixed vs variable spreads

You tend to be able to group spread betting companies by whether they offer fixed or variable spreads.

A fixed spreads broker will keep its spreads fixed during set market hours, no matter what is happening in the underlying market for the financial asset. It fixes its spread by market and these will be published on its trading platform. Traders get greater transparency of the costs of trading if trading with a fixed spread broker.

Like all commercial decisions, traders need to find the right balance for them and get value from the broker they choose. It really pays to do your research here and not just go for the broker with the biggest marketing budget – it has to be paid for somehow and its normally through a wider spread.

- Learn more, take our free course: Understanding Brokers

The time element

Time is also a factor in calculating the spread.

Daily spread bets will have a narrow spread reflecting the brief period of time the bet is priced for. Remember, traders will pay a fee to roll the bet overnight – this is discussed later.

The widest bid and offer spreads will be those for futures spread bets with the further away delivery dates. For futures, the ‘cost of carry’ is included within the spread. The cost of carry includes all costs for holding that asset from now until delivery/expiry. There are some exceptions but for most futures, the biggest cost of carry is the cost of borrowing the money to finance the position. Other costs of carry include transport, storage and security.

When spread betting, dividend adjustments are made to compensate for this. With a spread bet on a stock, you don’t actually own the underlying shares. Therefore, if you are long a spread bet you won’t directly receive any dividends that shareholders are paid during the time you hold your spread bet. To make up for this, the spread betting company will credit a dividend adjustment to your trading account if you’re long, if you’re short a debit entry will be made.

Other main costs of spread betting

For an active trader, the cost of spread will likely be by far their biggest cost. However, there are other costs that spread betting companies charge in addition to the spread.

1) Overnight funding charges on rolling daily bets

In practice, this is two charges wrapped into one – a fee to roll your daily bet and the interest charge for the leverage to fund the position overnight.

While an interest charge is built into the spread for futures, interest is an extra charge applied to rolling daily bets, based on how many days you keep your spread bet open.

The interest charge reflects the overnight cost of using leverage whenever you hold a spread bet open overnight. This a bit technical, but you are being charged the interest on top of the spread because the original bet was a daily bet, priced off the underlying asset’s cash market – this assumes immediate delivery and therefore no financing. You’ve chosen to extend it, so a fee is applied.

If you are selling short in your spread bet you will receive, rather than be charged, the overnight interest element. The overnight interest is calculated using a benchmark interest rate, like LIBOR.

Long: 2.5% rolling fee + LIBOR.

Short: 2.5% rolling fee – LIBOR.

The charge (or credit if you’re short and LIBOR > 2.5%) will be annualised to reflect the daily nature of the charge.

LIBOR has been very low for years, so in practice, most spread bettors will be charged overnight funding regardless of whether they are long or short.

Please note: the 2.5% rolling fee is used as an example. Again, these charges can vary from one spread betting provider to another but they are not a big area of commercial differentiation.

2) Special order fees

Spread betting firms also charge a small fee for using guaranteed stop-loss orders. These are stop-loss orders that guarantee an order fill at your specified stop-loss price, regardless of the current market price.

Effectively, the trader is paying the broker to take on the slippage and gapping risk of their trading.

3) Futures rollover cost

For the same reasons you’re charged to roll a daily position overnight, if an open spread bet on a futures price is nearing expiration, then you can choose to roll your spread bet over to the next futures expiration period.

The rollover charges vary by broker but typically the cost is half the prevailing spread. This makes rolling your futures bet over half the cost of closing your existing spread bet and opening a new spread bet for the next futures expiration period.

- Learn more, take our free course: Breaking Down Trading Costs

Conclusion

To make a profit spread betting, it’s critical to understand how trading costs are built into the spread and how this potentially affects your profit margin on each spread bet. The basic points to keep in mind are as follows:

- Every spread betting provider will charge a spread. This is what enables the spread betting company to make money.

- Spread betting companies offer either fixed or variable spreads. Variable spreads tighten and widen in line with the bid-offer in the underlying market, fixed spreads don’t and can offer greater transparency of trading costs.

- The width of a spread is determined by your broker’s commercial offering, underlying market and time frame of the bet.

- The other main costs of trading include overnight funding, special order fees and futures rollover fees.

- The spread is by far the biggest cost of trading for an active trader. Spreads can vary significantly from one broker to the next, so it pays to look around for good value.

Start learning now

Learn the skills needed to trade the markets on our Trading for Beginners course.